Finally good news for those considering getting a mortgage: the Czech National Bank (CNB) is removing some restrictions from next month.

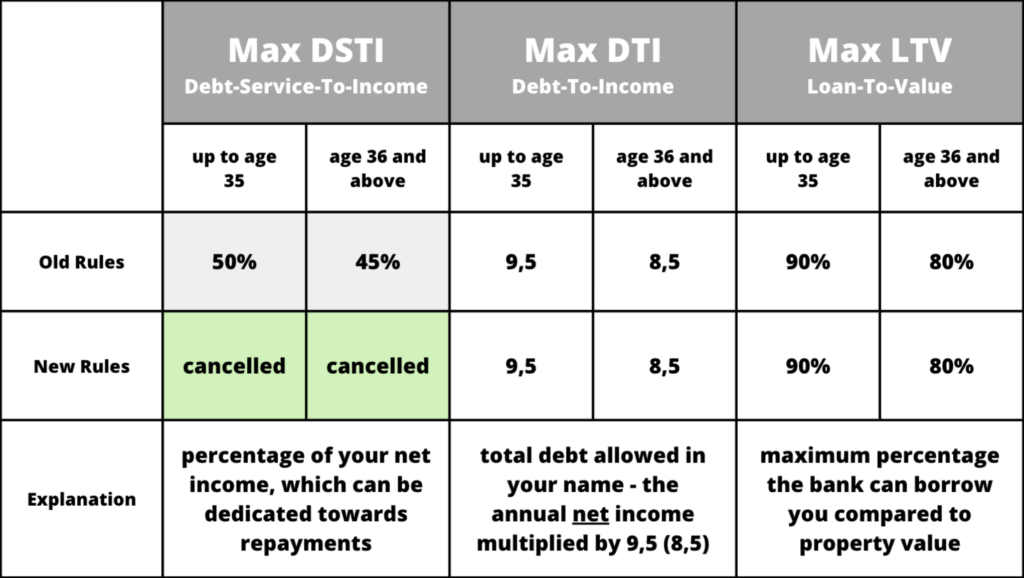

Last week, CNB board members agreed to remove the DSTI (debt-service-to-income) restriction, which was introduced in April 2022 to slow the market. At the same time two other restrictions, DTI (debt-to-income) and LTV (loan-to-value) were introduced, but unlike DSTI, they will stay in place.

The removal of the DSTI restriction will come into effect as of July, meaning the amount people can borrow would look as follows:

What is the limit on what you can borrow now?

Once the DSTI limit is removed, the maximum amount you could borrow for a mortgage will mainly be limited by the DTI ratio, which means you can borrow up to 9.5 times your annual net salary if you are 35 years old or younger. Those over the age of 36 can borrow 8.5 times.

For example: A couple is applying for mortgage with a net monthly income of 50,000 CZK + 60,000 CZK. With the DSTI rule removed, they can now borrow 12.54m CZK. If they are older than 36, that would be 11.22m CZK.

How did DSTI limit the above?

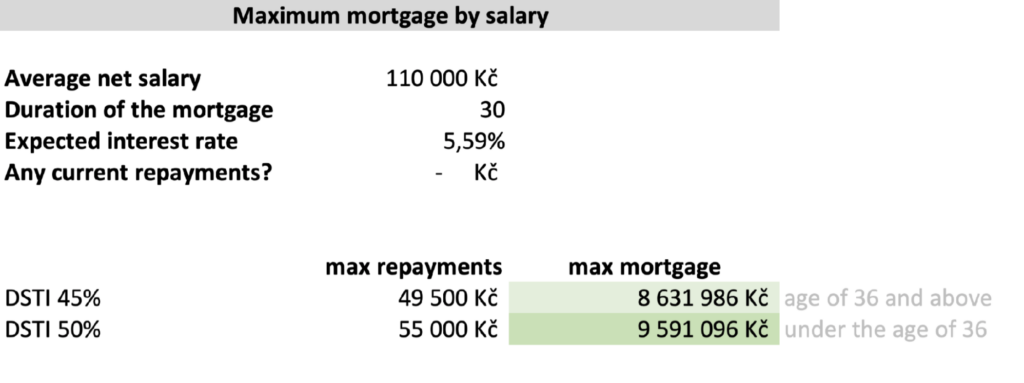

With the DSTI restriction in place, you can only dedicate up to 50% (45% for those over 36) of your net income to loan repayments. In the example above, the calculation would be:

So comparing these numbers, 8.63m CZK and 9.59m CZK to the above, you can see the removal of the DSTI restriction means you can theoretically borrow 30% more than before.

Does it mean I can borrow now 30% more than in May?

Theoretically yes, but… even if is it technically possible, it doesn’t mean the banks will actually offer this. While we wait to see how the banks will react to this we can only guess what they will do but I think we could expect one of two scenarios:

1. Banks will keep using the DSTI restriction as they have until now, ‘just in case’, which would mean nothing would change.

2. Banks will introduce their own calculations on maximum mortgage amounts, which is how it used to be before this restriction was introduced in 2022.

Personally, I think it will be the second option, so the maximum mortgage could be higher by 1-30% compared to what is now. Right now, the amount anyone can borrow is pretty much the same in all the banks due to DSTI but once that is removed, we might see more competition amongst the banks.

A reminder on LTV

The LTV rule states that the bank can lend you 90% of the property value for those aged 35 or younger, and 80% for those older.

For example, if a property is worth 10m CZK, the bank would lend up to 8m or 9m CZK depending on age, assuming you also pass the DTI criteria.

However, it’s important to keep in mind that the valuation can be different from the asking price. In case the property would not be valued at 10m CZK but rather 9.5m CZK, the bank would lend up to 7.84m or 8.82m CZK.

It is therefore very important to know the value accepted by the bank prior to signing the reservation contract, or try to negotiate with the agent return of the deposit should the value come lower.

One more thing to keep in mind is that if you are married and applying for a mortgage with your spouse, only one of you needs to be 35 or younger to get the higher amounts. If you are not married, most banks will apply rules for the older applicant though.

So, is this rule relaxation a good step?

As a mortgage advisor with 10 years’ experience, I have mixed feelings and personally I think the regulations could stay for a while.

If you imagine you would borrow up to 12.4m CZK (as the maximum DTI allows you), with a 5.59% interest rate and 30 years’ duration, that is a monthly repayment of 71,108 CZK, which would be a DSTI of 65%. That means you would be spending 65% of your net income just on mortgage repayments, plus do not forget electricity, house bills, insurance etc.

Whether it is good idea or not, I leave for you to consider.

-

NEWSLETTER

Subscribe for our daily news