Wondering how to sell a property burdened with a mortgage in the Czech Republic? There’s no need to worry – it’s a common scenario in the real estate market.

Selling a property with an outstanding mortgage does come with its specifics, but that doesn’t mean it’s impossible. What are your options when selling a property with a mortgage, and what should you prepare for?

There are several ways to go about selling such a property. However, the first step is always to obtain a mortgage balance statement from your bank, detailing the remaining mortgage amount by the time of the property transfer. You might visit a bank branch, but nowadays, most banks in the Czech Republic offer remote services – a call or filling out a form on the bank’s website might suffice.

What’s crucial in this step is how high the fees for early repayment will be. If the transfer coincides with the end of your fixed interest period, the fees will be minimal. In most cases, though, the sale won’t be timed perfectly with the interest period’s end, and it’s often unnecessary.

If your mortgage contract was signed after December 1, 2016, or you renewed the fixed interest after this date, the fees for early repayment will be minimal. This is due to the Czech Consumer Credit Act, which imposes modest charges. In cases of older mortgage contracts, early repayment fees might be substantially higher and could delay the sale.

In some cases, besides the mortgage balance statement, you might also need the bank’s consent for the sale and the buyer’s mortgage. You’ll notice this if there is a “restriction on alienation” noted on the ownership document.

This means you need the bank’s permission for the sale. Alternatively, there might be a “restriction on encumbrance,” indicating you need the bank’s approval for the buyer’s mortgage if they are financing the purchase with one. Both consents are formalities, and banks usually have no issue granting them.

So, with the mortgage balance statement and consents in hand, how does selling a property with a mortgage work in the Czech Republic?

Immediate payment in full

The smoothest way to sell a property with a mortgage is if the buyer has the entire purchase price available “in cash” to pay for the property. In this case, a portion of the purchase price will be used to repay the mortgage, and the remainder will be credited to your account.

The bank will provide you with a detailed mortgage balance statement (indicating the remaining amount to be repaid) to the exact transfer date. You’ll sign the sales agreement with the buyer, and they will transfer the entire purchase price to an escrow account held by a lawyer, notary, or other entity as per your agreement. After the transfer is registered in the land registry, the amount needed to settle the mortgage will be released from escrow directly to your bank, and the remaining amount will go to your account.

However, in today’s market, it’s relatively uncommon for a buyer to have the entire purchase amount readily available. Typically, buyers finance their purchase with a mortgage.

Mortgage financing

Many property buyers in the Czech Republic must arrange a mortgage loan to acquire a property. The same applies to properties with an existing mortgage. Be prepared for a slightly extended process due to the administrative tasks involved in arranging the buyer’s mortgage (such as property valuation, verifying the buyer’s income, and the bank’s approval process).

Once the buyer’s loan is approved, you’ll request a detailed mortgage balance statement from your bank to the exact transfer date. You’ll sign all transfer-related agreements with the buyer, following which the buyer will send a portion of the purchase price to an escrow account to be funded from their own resources. Then, the buyer will register a lien agreement in the land registry, and the mortgage bank will disburse the loan amount to the buyer’s account, a portion to your bank as per the balance statement, and the rest to escrow. After the property transfer is registered in the land registry, the escrow amount will be released to your account.

Hooray, selling time!

In other aspects, selling a property with a mortgage in the Czech Republic doesn’t differ much from a “regular” sale. You’ll still need to assess the property value, determine the market price, create an ad, promote the property, enhance its appeal for potential buyers, and organize viewings and price negotiations.

As with any property sale in the Czech Republic, you have the option to carry out the process independently or through a real estate agency or agent. While some might be concerned about professional fees affecting their profit, the opposite is usually true. An experienced real estate agent familiar with the Czech market can accurately assess the property value, assist with viewings, actively seek potential buyers … And, most importantly, they’ll guide you through the administrative maze, which can be complex when selling a property with a mortgage. Professionals ensure you won’t encounter any unpleasant surprises.

Are you selling a property and want to take the hassle out of the transaction? Put the sale in the hands of our experienced real estate brokers. At Kotula Real Estate Agency, we will guide you through the entire process and make sure you get the maximum amount for your property. Contact us!

Selling a cooperative apartment in the Czech Republic follows different rules compared to selling a personally-owned apartment.

But don’t worry—though it might seem like there’s more to navigate than selling a regular flat, it’s not a complex process. What do you need to arrange for a successful sale of a cooperative apartment?

How do cooperative apartments in the Czech Republic differ from individually-owned ones? The biggest distinction lies in the owner—while the ownership of a personally-owned flat is registered under a specific individual’s name, with a cooperative apartment, the housing cooperative is the owner, and you are a tenant of this cooperative with a membership share in it. This means that when selling, you have different rights and obligations compared to a “regular” apartment owner. So, how does the sale of a cooperative apartment in the Czech Republic work?

Notifying the cooperative

Since you’re not the owner of the cooperative apartment, you also need to involve the cooperative in the sale. Therefore, it’s advisable to consult the statutes to understand the conditions under which you can sell your membership share within the cooperative. Discuss your intention to sell with the cooperative and determine the conditions for transferring the share. These might involve restrictions on who can become a new member of the cooperative.

Also, request a confirmation of your membership in the cooperative and your debt-free status with the cooperative. The cooperative should also provide you with a document stating the remaining amount of the annuity, if you haven’t fully paid it yet. Prospective buyers will likely be interested in monthly charges and other fees payable to the cooperative.

Find out the fee that the cooperative charges for transferring a membership share and whether there’s a possibility of transferring a cooperative apartment into personal ownership.

What about the price?

Have you gathered all the necessary information for the share transfer? Fantastic! Now, you face several important steps. The first one is to determine the price at which you’ll sell your membership share in the cooperative. Unlike with apartment owners, apart from considering location, size, and nature of the apartment, you’ll also need to account for the fact that it’s a cooperative apartment. It might result in the price being slightly lower. What are the reasons for that?

Most importantly, a prospective buyer will be purchasing a membership share within the cooperative, not the apartment itself. This means that if they wish to rent out or renovate the apartment, they’ll have to first approach the cooperative, which must approve the rental or renovation. While this is often a formality, it’s an additional step to consider. An exception is when the cooperative is planning to convert membership shares into personal ownership in the very near future. In such a case, the value of a cooperative apartment equals that of an individually-owned one, as ownership is about to change.

Another reason cooperative apartments in the Czech Republic are slightly cheaper is because buyers of these apartments have somewhat limited financing options. When applying for a mortgage, they must use a different property as collateral (unlike personally-owned apartments, where the purchased property serves as collateral; this isn’t possible with cooperative apartments, as they remain under the ownership of the cooperative).

However, in other aspects, the price of a cooperative apartment in the Czech Republic is determined just like any other property—thus, it depends on the condition of the apartment, floor level, layout, and so on. While you can estimate the price yourself, it’s usually better to seek an expert’s valuation, typically from a real estate agency. In many cases, if you use their services to sell the apartment, you’ll get a property valuation for free. If you’re hesitant about using a real estate agency due to commission concerns, learn how the process is actually determined. Also, be aware of what to consider when drafting an exclusive contract with a real estate agency.

Advertisements, viewings… and the cooperative again

After determining the price at which you’ll sell your cooperative apartment in the Czech Republic—or rather, your membership share within the cooperative—it’s time to let everyone know that your apartment is up for sale. This involves sprucing up and photographing the apartment, creating an ad, and spreading the word. You’ll conduct viewings with potential buyers and then select a buyer.

Once you’ve chosen a suitable buyer and agreed on the price, it’s time for contract signings. Be sure to have a lawyer specializing in property involved. Unlike with individually-owned apartments, you won’t be drafting a standard sales contract; instead, it’s a membership share transfer agreement within the housing cooperative. This is followed by an escrow agreement, or other necessary documents as required.

Then, you simply deliver the membership share transfer agreement to the cooperative, which will then issue a rental agreement to the buyer. Unlike with selling personally-owned apartments, you don’t need to transfer the ownership of the apartment in the property register—ownership remains with the cooperative. As a result, the final phase of the sale is slightly faster and more convenient, as you don’t have to wait for the property register entry, which usually takes about a month.

Are you looking to sell a family house in the Czech Republic, but are unsure how to proceed? We’ve got you covered with a comprehensive guide on what needs to be arranged before selling, how to prepare the house for sale, and how to maximize the value of your property.

Selling a family house is generally a bit more complicated and can take longer than selling an apartment. After all, buyers are usually looking for a home for a lifetime, a place for their family, and that decision naturally takes more time. Furthermore, there is slightly less demand for houses in the Czech Republic compared to apartments. That’s why it’s essential not to underestimate anything. If you’re uncertain about how to sell your house, we’re here to help!

Start at the cadastre

Your first step should be a (virtual) visit to the ‘cadastre’ (the land registry of the Czech Republic). You should verify whether the information in it matches reality – from the owner to the land area and all the structures on the property. If you discover any discrepancies, such as an unapproved garage or a fence in the wrong place, it’s important to rectify everything. The relevant authorities can assist you with this.

Even though addressing such issues might require a fair amount of work, definitely don’t ignore the discrepancies. There’s nothing worse than a potential buyer who’s nearly decided to purchase your house realizing that part of the garden is actually on the neighbor’s side of the fence, or that the access path to the house is on privately-owned land, without a legal right of way. Moreover, various discrepancies could complicate the buyer’s ability to secure a mortgage.

Determining the selling price

One of the most critical steps in selling a family house is estimating its price, and this can be quite a challenge. If your asking price is too high, your offer might attract only a fraction of potential buyers. On the other hand, if the price is too low, you might have too many interested parties and then have to figure out how to raise the price in a suitable way, so you don’t upset potential buyers while still getting a price that reflects the actual value of the family house.

If you decide to estimate the price on your own, browse advertisements for similar properties for sale in your area. Just remember that in the current Czech real estate market, there might be fewer comparable ads, and you can’t always be sure if the listed price is a genuine market value. There are also paid property estimation apps, but they can often be complex for beginners. Various online calculators might not take all the necessary criteria into account.

Therefore, it’s worthwhile to entrust the price estimation to a professional, like a real estate agent or agency. Most of them offer property appraisals for free if you decide to use their services for selling. If you plan to sell the house on your own, prepare to pay around 3,000 to 5,000 crowns for a family house price estimate.

So, what actually influences the price when selling a house in the Czech Republic? Firstly, it’s essential to note that aside from the house itself, you’re also selling the land. Therefore, the price is essentially composed of two parts: the value of the building and the value of the land. Consider the location first, then the age, size, and condition of the house, and finally, evaluate the land – its size, characteristics (sloped, with a garden, just grass, etc.), potential for further construction, amenities (garage, workshop, pool, etc.). All these factors significantly impact the price, but they can be quite challenging for non-experts to assess.

House versus Home

If you have all the necessary details sorted and a set selling price for your house, it’s time to move on to its preparation for photography and viewings. If you’re not selling a brand-new building, you have some work ahead. Remember, the house should present itself in a way that prospective buyers can envision it as their home. Bare walls with peeling paint, wallpaper coming off, and mildew-covered spaces don’t make a great impression. On the other hand, a house crammed with outdated furniture from the 40s, untouched since then, won’t feel cozy either.

Clean up the house as much as possible, give it a fresh coat of white paint, and keep only the basic furnishings. Though this might seem like a lot of unnecessary work, time, money, and energy, trust that you’ll see the returns in the increased number of interested parties and potentially a higher final selling price. Pay attention to the land as well – it needs to be mowed, any clutter or junk removed, and generally tidied up.

Some companies offer what’s known as home staging – arranging your house to make it look cozy and more appealing to potential buyers. Essentially, interior designers take care of everything for you. You can find them online or get a recommendation from a real estate agent you’re collaborating with on the house sale. Real estate agencies can also provide additional advice on how to prepare your house for sale, as experienced agents know exactly what appeals to buyers.

Cast your nets

Once your house is ready for presentation, take photographs of it and prepare the listing. The pictures should clearly showcase the house’s appearance, location, and layout. It’s worth enlisting the help of a professional photographer who specializes in real estate and knows which angles work best. You might also consider adding a video tour or a virtual 3D walkthrough. An expert can assist you with these, or your real estate agent if you’re using their services. Include a floor plan in your visual materials, illustrating the layout of the house or its different levels. Potential buyers should have the most accurate idea of what the house is like.

Don’t underestimate the importance of the text in the listing. Besides all the essential technical specifications, it should be written in a way that captures the reader’s attention and conveys the atmosphere of the house. If your house or its surroundings have something interesting to offer (such as original 1930s stucco work or an amazing sunset view from the terrace), mention it!

Place your listing on Czech real estate websites and social media. Ask your friends to share it. If you entrust the house sale to a real estate agency, you’ll also tap into potential buyers from their client base, whom you wouldn’t have reached otherwise. Additionally, real estate agents in the Czech Republic undestand how best to enhance and widely promote their listings.

Get ready for visits

Potential buyers can’t make their purchasing decision based solely on your listing, and so they will definitely want to see the property in person. You can arrange individual viewings, but if there are several interested parties, you might consider hosting an open house event. Prepare to act as a guide through the house, ready to answer many questions. Communication with potential buyers is crucial – creating a pleasant atmosphere and understanding their needs will help them better appreciate the family house itself.

However, buyers aren’t the only ones who should be asking questions – it’s essential that you assess the potential buyers as well. Ideally, you should know why they’re considering purchasing the house and what specifically caught their attention in your listing. This information will allow you to present the house in a way that caters to their needs. If a young family looking for a garden to grow vegetables in and a play area for the kids is visiting, emphasizing the garden’s great features will be crucial. If an older couple seeking peace and quiet are interested, then highlighting the serene and quiet environment will be key. Also, be prepared for the fact that not everyone coming for a viewing has the intention to buy (some might simply be curious or not even looking for a property), or they might have a significantly different price expectation than you. If a real estate agent is handling the sale for you, you won’t need to worry about these formalities – they’ll take care of it all on your behalf.

Ready to Sign

Have you found a buyer you’re comfortable with, and you’ve agreed on the price, sale terms, and property financing? Fantastic! Even though it might seem like the hardest part is behind you, hold off on celebrating just yet. Administrative and legal tasks await you, which will turn the sale of the house in the Czech Republic into a reality.

It’s worth arranging for a professional technical property inspection, which will confirm that you haven’t concealed any hidden defects of the house from the buyer (this could potentially come back to haunt you in the future). Then, it’s time for the contracts. These should always come from the hands of a lawyer specializing in real estate. Never download a house sale contract from the internet! If you’re selling the property through a real estate agency, you’ll save yourself a lot of worries and often even money on lawyers and such.

You’ll also need to establish an escrow account and request the registration of ownership rights in the land registry. Additionally, a handover protocol for the house will come in handy. After completing all the administrative steps, everything is finally ready for signing.

Are you selling a property and want to take the hassle out of the transaction? Put the sale in the hands of our experienced real estate brokers. At Kotula Real Estate Agency, we will guide you through the entire process and make sure you get the maximum amount for your property. Contact us!

Are you thinking about selling your apartment or flat in Prague and wondering about all the steps you need to take to get the maximum value for your property or ensure a hassle-free transaction, and above all, do it quickly?

In this article, we’ve got some tips for you on how to go about selling your apartment.

You might be thinking that selling an apartment in Prague can’t be that different from selling one in other regions, right? Well, the rules are pretty much the same in places like Uherské Hradiště as they are in the capital city. However, the Prague real estate market has its unique features that you should keep in mind. It starts with the number of apartments available and ends with their prices. So, how do you sell an apartment in Prague?

Is Prague expensive?

When we talk about the real estate market in Prague, what often comes to mind is the high prices at which apartments are offered in the city. As a seller, this could work in your favour, because you’d get an amount for your property that you might not get in most other regions. However, for some sellers, this might lead to the idea that they can ask for almost any amount for their apartment. But that can be a mistake, and there are two reasons for that.

The first is the phenomenon of “overpricing”. Under the impression that everything sells in Prague for any price, you might artificially inflate the price of your apartment. However, you can’t really expect potential buyers to jump at it. What’s worse, you might miss the opportunity when the market is most favorable for a high price. The longer you try to sell it, the more your property might lose value, and even offering discounts might not help, as buyers could think something’s wrong if the price keeps dropping. On the other hand, there’s also the situation of “underpricing” your apartment. In that case, you won’t get a fair amount for your property, which is a shame, of course.

The solution is to have an expertly estimated price for your Prague apartment. Any experienced real estate agent who knows the Prague market well can do this. And if you decide to use their services to sell your apartment, you’ll most likely get the estimation for free from most real estate agencies. If not, be prepared to pay a few thousand crowns for it.

Speed matters

Another thing that sets apart the sale of an apartment in Prague from sales in other regions is how quickly properties are snapped up from the market. To put it simply, there’s a huge demand for apartments in the capital city. This isn’t just because more and more people are moving to Prague, but also because there aren’t that many apartments available in the city.

Smaller apartments—like studios and 1-bedroom units (garsonky or 2+kk)—are the quickest to sell (typically within two months). And the reason is quite straightforward – these units are perfect as starter homes for young individuals or childless couples. They are also attractive to seniors and couples whose kids have flown the nest, and are no longer interested in a spacious apartment. Additionally, investors put their money into these smaller apartments and then rent them out. For larger apartments, sellers usually need to wait a few more weeks. On average, Prague apartments sell within about three months from when they are listed.

The speed at which an apartment in Prague sells is influenced by factors other than just its size. Apartments in prime areas in the city center and broader central Prague tend to sell faster, and having a metro station nearby also helps. As for the apartment itself, it’s ideal if it’s on a higher floor with an elevator, in a well-maintained apartment building, and in a peaceful street.

Be attractive

Making the sale of your apartment easier can also involve presenting the property well. Even though some sellers underestimate the importance of writing good listings, it’s essential to remember that the listing is the very first encounter a potential buyer has with your property. So, it’s worth making it as appealing as possible.

If you’re selling your Prague apartment on your own, without involving a real estate agency, it’s a good idea to go through as many professional listings as you can to get an idea of how they look. On the other hand, if you’re using the services of a reputable real estate agency, you won’t need to worry much about promoting your apartment. They’ll take care of many other aspects related to selling (like finding and screening potential buyers, getting the apartment ready for viewings, professional photography, contract preparation, and more).

A helpful approach to ensure you don’t overlook anything is to look at the selling process from the buyer’s point of view.

Are you selling a property and want to take the hassle out of the transaction? Put the sale in the hands of our experienced real estate brokers. At Kotula Real Estate Agency, we will guide you through the entire process and make sure you get the maximum amount for your property. Contact us!

If you’re buying or selling property in the Czech Republic, you’ll come across the term “escrow of funds (úschova peněz)” or “escrow of the purchase price (úschova kupní ceny).” What does these terms mean, and why should you always make use of escrow?

Let’s take a closer look at this article.

In general, when selling or buying property in the Czech Republic, you can choose from three basic types of escrow for funds. These are:

- Lawyer’s escrow

- Notary’s escrow

- Bank escrow

There’s also a special fourth category, which is the real estate escrow, meaning funds are held directly by the real estate agency.

Each type of property escrow has its own advantages and disadvantages when selling a property. So what are they, and what factors should you consider before deciding on the one that suits both the seller and the buyer?

Do you really need it?

Are you wondering why escrow of funds is important when selling an apartment, house, or land? Well, the reasons are quite crucial, even though the buyer and the seller usually have different motivations for choosing the right type of escrow.

In the Czech Republic, escrows are mainly used because there’s a gap of approximately 30 days between signing the purchase agreement and registering the new owner in the land registry. Throughout this period, both parties need to be protected.

Buyers might worry that if they send money to the other party before their ownership rights are registered in the property registry, the seller could take the funds and disappear. In theory, the seller could keep offering the property and collecting money for it without actually transferring it to the buyer (though this scenario might be a bit far-fetched, as scammers can be quite inventive).

So, what prompts the request for escrow of funds when selling a property? The seller would take a significant risk if they signed the purchase agreement and initiated the transfer of ownership rights in the registry without being certain they’d receive the payment from the buyer. After all, in an extreme case, the buyer might never send the necessary funds (maybe they never even had them), yet still end up registered as the new owner.

It’s clear, then, that escrow of funds when purchasing property in the Czech Republic (or selling it) is essential for both parties. But which option should you choose?

Bank escrow of funds

Bank escrow comes with clear advantages – the risk of losing your money due to fraud or embezzlement, for example, is practically zero. Additionally, Czech banks are to a large extent covered, highly insured, and regulated by state institutions.

However, the downside of a bank escrow could be the cost. It’s usually higher than what you might pay, for instance, at a law firm. Also, you might have limited scope to negotiate the terms in the escrow contract – banks usually have their standard escrow contract template and are willing to make only minor adjustments to it.

Lawyer’s escrow of funds

This form of escrow is quite popular in the Czech Republic. One of the reasons is the cost, which is slightly lower compared to a bank or notary’s escrow. It’s also practical because the lawyer preparing the purchase agreement can package it together with the escrow agreement – therefore you only need to communicate about the property transfer with one person who’s well-versed in the entire case. Furthermore, lawyers can incorporate many more revisions into the escrow agreement than a bank or a notary might be willing to.

Unfortunately, there have been instances in the past where lawyers misappropriated the held funds. Therefore, it’s essential to consider which lawyer you’ll entrust with the property’s purchase price. The lawyer should meet a range of rules set by the Czech Bar Association, including having a separate account set up for escrow purposes, and they must also report each escrow to the bar association.

Although lawyers in the Czech Republic are mandatorily insured up to at least 5 million Czech Crowns, given current property prices, this insurance might not be sufficient for lawyer’s escrow. Moreover, the insurance doesn’t cover property loss or potential misappropriation. Therefore, it’s crucial to pay attention to the selection of the law firm you’ll trust with your funds.

Notary’s escrow of funds

Escrow of funds with a notary works on a similar principle as with a lawyer. Notaries are also legally insured in the Czech Republic, although even here, insurance has its limits. The cost of notary escrow is determined by the notarial tariff, which is regulated by the current decree. However, of all the different types of escrow, a notary’s escrow is the most expensive.

Similarly to choosing a lawyer, opt for a reliable notary for your escrow of funds to ensure your money is safety. It’s not true that a notary, being a state employee in the Czech Republic, is a “guaranteed” entity. In the case of escrow misappropriation, the state is not responsible for the lost funds – the same as with other types of escrow.

Escrow of funds with a real estate agency

It’s possible to deposit money with a real estate agency as well. However, according to current legislation, Czech real estate agencies cannot offer escrow on their own – they can only provide it if clients request it in writing.

For real estate agencies (similarly to other types of escrow), the money must be held in a separate account. As for the cost of escrow, many real estate agencies offer this service for free as part of other services related to property sales.

However, we generally do not recommend the escrow of funds with a real estate agency. While escrow has its rules, the official oversight of Czech real estate agencies is minimal – unlike the supervision of lawyers, notaries, or banks, which makes escrow through a real estate agency very risky.

In our real estate agency, we only arrange escrows with reliable law firms or banks, and this is included within the standard commission fee.

Escrow agreement for funds

It’s essential when buying/selling property in the Czech Republic to draft an escrow agreement for funds. What should you watch out for? The escrow agreement, or a template, is usually available from escrow providers, i.e., escrow specialists.

The escrow agreement must stipulate how and within what timeframe the buyer will pay the purchase price into escrow and under what conditions the escrow agent will release the purchase price to the seller. Additionally, the agreement must contain provisions for how the purchase price will be handled if the transfer of ownership rights to the buyer doesn’t occur.

Are you selling a property and want to take the hassle out of the transaction? Put the sale in the hands of our experienced real estate brokers. At Kotula Real Estate Agency, we will guide you through the entire process and make sure you get the maximum amount for your property. Contact us!

Are you thinking about selling an apartment, family house, or land in the Czech Republic, but are unsure about all the steps you need to take for a smooth transaction and to get the best price?

In this article, we’ll guide you through the process of selling property.

Right from the start, it’s important to mention that if you decide to sell property in the Czech Republic entirely on your own, that is, without the help of a real estate agency, you’re in for a quite challenging time. Many people believe that selling “by themselves” will lead to higher profits because they won’t have to pay for a real estate agent’s services.

However, this is rarely the case. Even after paying commissions etc., a reputable real estate agency can help determine a better value for your property, promote it effectively, and find suitable buyers, leaving you with more money. The important factor here is that you must work with a quality, reputable real estate agency. However, if you do decide to try and sell your apartment, family house, or land on your own, let’s explore how to sell property without involving a real estate agent.

Setting the price

The first question that comes to anyone’s mind when selling property is undoubtedly what price to sell at. Setting this price isn’t the easiest of tasks, especially if you’re not familiar with the real estate market. Some ways you can go about this is to look through existing ads offering similar properties in your area, use online property price calculators, download specialized Czech databases designed for this purpose, or check the land registry. These resources will give you an idea of the kind of price you can offer your property at in the Czech Republic.

However, be aware that this doesn’t guarantee you will be able to sell your property at that price. The estimated price is not final. The real estate market in the Czech Republic is a dynamic entity that is constantly evolving, and what held true a month ago might not be the case today. Additionally, you might overlook crucial details that impact the property’s estimated value.

Given that determining the property’s selling price is quite complex, it’s wise to obtain a professional valuation. Most real estate agencies offer this service, and its cost in the Czech Republic the cost ranges from 2,000 to 5,000 Czech crowns, depending on the property type. This will give you a very accurate price estimate, making it a meaningful investment. If you do evetually decide to use a real estate agent for the sale, property valuation is often free.

Paperwork when selling property in the Czech Republic

Before excitedly posting your ad, it’s a good idea to ensure you’ve covered all the property-related requirements. For selling land, make sure you are certain of its type (meadow/field, building plot, garden, etc.) or the zoning plan. If you’re selling a family house, check the land registry to verify if everything matches the actual state of the property. Also, make sure unexpected surprises like an unapproved garage in the backyard don’t catch you off guard.

Additionally, ensure you have all the necessary property documents, especially proof of ownership, land registry documents, acquisition title, and potentially an energy performance certificate. A slightly more complicated situation arises if you haven’t fully paid off any mortgage you have on your property.

Making Your Property Shine

Once you know the price at which you want or can offer your property on the Czech real estate market, and all the necessary aspects are in order, it’s time to prepare the house, apartment, or land for sale. This way, you can present it in the best possible light in your advertisement (and later during viewings).

It’s worth giving your property a thorough clean, investing in minor repairs, and even repainting the apartment or house (ideally in white to create a clean look). You can also mow the lawn and clear away any clutter from the garden.

While it’s fine to carry out some basic improvements by yourself, to increase the attractiveness of your apartment or house even as much as possible, consider enlisting the help of experts in home staging. Interior designers can make your property more inviting, attracting even more potential buyers. If you’re selling property on your own in the Czech Republic, you can find companies specializing in home staging online. If you’re working with a real estate agency, they can point you in the direction of experienced interior designers.

Capturing images with a camera and drone

Now it’s time to gather visual material for your ad. It’s not a good idea to casually snap photos of the apartment or house with your phone. Firstly, you should take pictures when the lighting is at its best (to create an airy feeling and visually larger space). Secondly, investing in a quality camera is very worthwhile here. It’s definitely worth the investment of entrusting your visual advertisement material to a professional who specializes in real estate photography. Additionally, when selling a house with a garden or land, aerial photos or videos taken with a drone are very popular these days.

Then, there’s the “small” matter of crafting the text for your advertisement. In addition to providing technical details about your property, mention interesting features that might seem insignificant at first glance but actually enhance the appeal of the ad. For instance, if you’re selling an apartment suitable for a family, it’s worth mentioning how close it is to a playground or kindergarten. For smaller apartments mainly targeted at younger individuals or couples without children, highlighting nearby restaurants or cultural amenities could be helpful. However, keep in mind that the aim is not to write an exhaustive document – remember that overly lengthy ads are rarely read to the end.

Where to place it?

You should place your advertisement on the most visited Czech real estate websites (such as sreality.cz and others). Some of these platforms offer a service called “topování,” which keeps your ad in prominent positions on the page for an additional fee. It’s definitely worth considering paying for this service; otherwise, your ad might get lost among others, and only a small number of potential buyers will see it. Don’t forget about social media either – ask your friends to share your ad as much as possible.

Still, it’s important to note that the information about your property being for sale might not reach as many people as it would if you were using a Czech real estate agency. Their staff members know how to grab attention with an ad, where to promote it, and more. Plus, they don’t just wait for inquiries to come in – they actively seek out potential buyers and actively present the property to their clients.

When interested buyers enter the scene

So now, your advertisement is successful and potential buyers are reaching out? Fantastic! Be prepared that they’ll want to view the property. During these viewings, always try to highlight aspects that are attractive to the specific buyer (foor example, a family with kids might appreciate a safe and spacious garden, proximity to schools and kindergartens, while an older couple might value a peaceful location, or a young couple might focus on accessible public transport).

However, always keep your safety in mind – after all, you’re allowing strangers into your home or apartment. Although the chances are slim that any of them have unpleasant motives, it’s best to remain cautious.

Also, expect that the price of the property will come up for discussion at some point. Since the price listed in the ad is usually not final, be prepared for negotiations. If you know you can’t go below a certain price, stand your ground. It’s understandable that buyers want to get the property as cheaply as possible, but they also need to realize that your goal is the opposite. In this regard, the situation is easier if a real estate agent is selling the property on your behalf; their experience allows them to estimate how far they can push the price and how to achieve the highest possible sale value for you.

Finally, success!

If you’ve found a buyer and you’ve agreed on the price, you can now move to the last step – the actual property sale itself. You should entrust contracts and other important documents for property sale in the Czech Republic (such as a handover protocol) to a property lawyer specialized in this area. Definitely do not attempt to draft them yourself or copy them from the internet!

The lawyer will also facilitate the safekeeping of financial funds (escrow) during the period before the transfer is completed in the land registry. Escrow services are also offered by real estate agencies or certain banking institutions.

In conclusion, then, selling property in the Czech Republic on your own can be a lengthy and complex process. That’s why it’s worthwhile to entrust the sales process to experts from a real estate agency. You’ll be able to get a lot of worries and stress off your plate, and most importantly, you’ll have the assurance that you’re selling your apartment, house, or land for the highest possible price.

When dealing with a Czech real estate agency, you’ll likely come across the term ‘exclusive contract‘ (exkluzivní smlouva).

It‘s important to understand the implications of these kinds of contracts and what you need to take into consideration before entering into one. In this guide, we’ll delve into the details of these contracts and give you insights into how to set them up correctly. Let’s get started.

What is an exclusive contract?

Essentially, an exclusive contract means that you, the seller, must cooperate only with the real estate agency with which you have entered into the exclusive contract, and for the entire period of the contract.

Disadvantages of an exclusive contract

Limited cooperation

For the seller, this type of contract is a ‘bet on one card‘. If the real estate agency turns out to be incompetent, you cannot simply terminate your cooperation with them, because you are tied in until the end of the contract. This can be especially annoying if you are in a hurry to sell your property.

Penalties and sanctions

Any exclusive contract with a real estate agency will include various restrictions, sanctions, and penalties. These are intended to force the seller to maintain their cooperation with the agency should he or she want to terminate the cooperation for any reason.

Remuneration in any case or scenario

Based on an exclusive contract, the real estate agency is entitled to remuneration even if the buyer is found, for example, from among your acquaintances or friends, even though the real estate agency did not contribute to finding the buyer.

The benefits of an exclusive contract

A quality real estate agency will only carry out exclusive work for you

A quality real estate agency will have enough clients and experience to know whether and to which tasks it should devote its time and resources. Therefore, non-exclusive commissions are clearly not appealing to them. Under a non-exclusive agreement, the status of the commission is not fully under their control, so the real estate agency cannot reliably pass on information to those who may be interested in buying. Additionally, there is no guarantee that the real estate agency will ultimately be rewarded for its time and effort.

A real estate agency invests in marketing

In order to get more money from the sale of the property, the real estate agency needs to invest in marketing. And, if they do this honestly, the marketing costs for each property can reach at least 10 to 30 thousand Czech crowns. Therefore, we can see why they would not be willing to invest this amount of money under a non-exclusive agreement.

My recommendation

It’s all about choice

So as we can see so far from this guide, exclusivity has its advantages and disadvantages. It’s therefore essential to find a quality real estate agency and take advantage of the benefits of the contract, and avoid choosing the wrong one and under a contract that will only hold you back. I wish at this point I could give you a simple formula that will help you easily decide which real estate agency is of a high quality, but unfortunately, I do not know of one.

Contract duration

When starting your cooperation with an agency, consider setting a shorter contract duration, such as 2-3 months. This initial period allows you to assess the real estate agency’s performance, and if the cooperation is successful, you can easily extend the contract. It’s worth noting that under the Act on Real Estate Brokerage in the Czech Republic, an exclusive contract between a real estate agency and a client can be established for a specific period, with a maximum duration of 6 months.

How we view exclusive contracts at the KOTULA real estate agency

In our view, the collaboration between a real estate agency and a seller hinges on mutual trust. If this trust isn’t established, the type of contract between the parties becomes less significant. If the seller wishes to terminate the partnership, they might wait until the contract concludes or seek early termination through various means.

On the other hand, if the seller is satisfied with the real estate agency’s performance, a formal contract might not even be necessary. A natural inclination to cooperate then arises, driven by a desire to reward the agency for its effort. At KOTULA Real Estate Agency, our contracts are founded on mutual trust. They have been intentionally simplified to take up just one page at most, while also eliminating any constraints or penalties directed towards clients.

Just as nature has its more favorable seasons, so the property market is similar. There are months when property sells well and months when the demand is very low.

Therefore, it pays to plan ahead when thinking about going to market. A poorly chosen period means a slow sale at a lower price, whereas a well chosen period can result in a quick sale at a higher price. If you plan to sell real estate in the Czech Republic, you can schedule your sale based on the advice I’ll give you in this article.

When is the best time to sell a property?

Well, in the Czech Republic, the best time for selling homes is during the spring. The next good option is late summer. But remember, it’s not set in stone – other things matter too, like the type of property you are selling.

If you’re looking to put your property on the market, March is a great month. That’s when a of potential buyers start actively looking. Usually, there are more people wanting to buy houses than there are houses available, creating a competitive atmosphere that might speed up the selling process and maybe even get you a better price. On the flip side, the least ideal times to sell in the Czech Republic are during the summer vacations and winter.

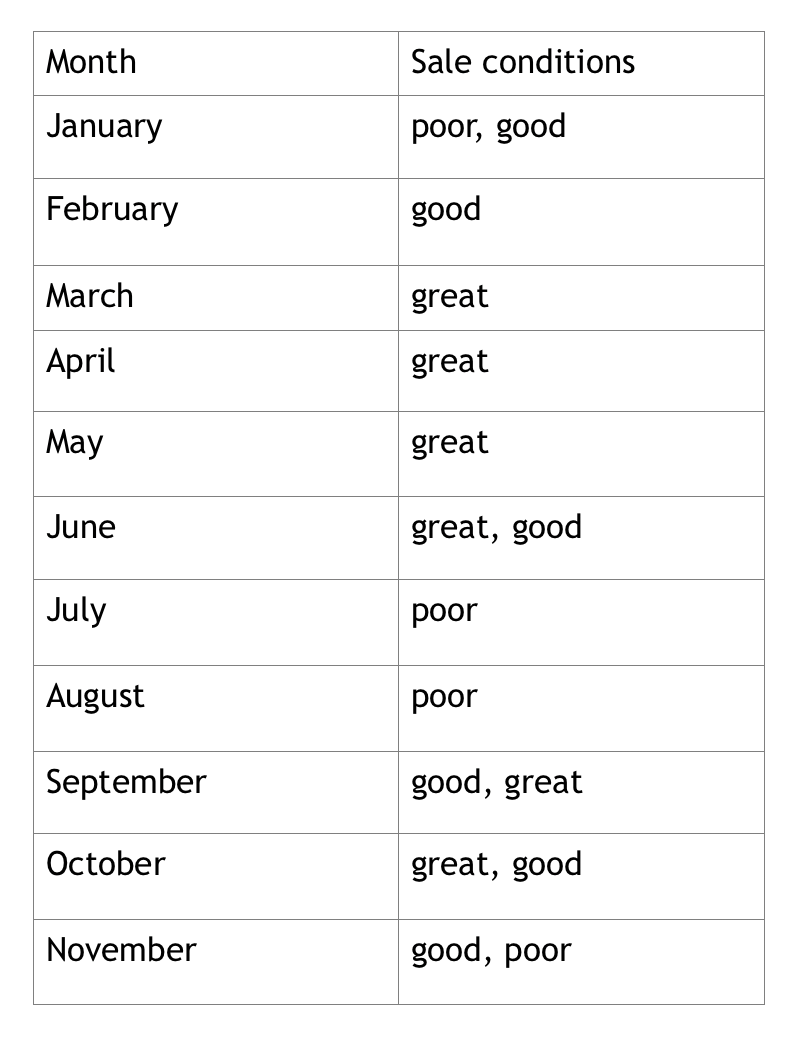

Here’s a quick breakdown of how each month shapes up for selling:

How do individual properties sell?

Apartments such as 1+kk, 1+1, 2+kk and 2+1

The time of year when you’ll find interest from buyers here is the longest and most corresponds to the table above. As a rule, buyers are young people who have plenty of free time and are not limited by other commitments that might complicate their search for a property at other times of the year.

Family apartments, houses, or land for building family homes

When you’re dealing with family apartments, houses, or land for building family homes, it’s important to be mindful of when potential buyers, especially families, have their hands full with taking care of their children or are away on vacation. These concerns tend to peak during the Spring holidays, which can vary in timing from place to place.

To maximize your chances, it’s a good idea to figure out the exact week when these holidays occur in your area. As for other holidays like summer and winter breaks, they generally coincide with decreased interest, as indicated in the chart.

Vacation properties

Turning our attention to vacation properties, interest is usually high when it’s most convenient for people. During these times, people are looking to escape to nature and a peaceful setting, engage in hobbies, or even gardening projects.

The prime season for selling cottages and country retreats in the Czech Republic spans from spring to autumn. On the other hand, summer and winter are the peak periods for selling mountain apartments or cabins.

Which day of the week is the best to start advertising in the Czech Republic?

When it comes to choosing the best day to start advertising your property, it’s important to consider the days when online ad portals experience the highest number of visitors. Generally, the peak interest occurs on Mondays, Tuesdays, and Wednesdays, followed by a gradual decline throughout the week, with the least engagement on Sundays.

Therefore, the best time to launch your offer is Monday morning. By doing so, you’ll capture the attention of the most enthusiastic potential buyers right from the outset.

This is a frequent question we get from clients who plan to invest in property in the Czech Republic, whether that’s an investment in apartments, apartment buildings, land or commercial real estate.

The answer is very simple: if you plan to own the property for a substantial time, then in the vast majority of cases it is much better to buy the property in your name, primarily because of the income tax savings you’ll make should you decide to sell the property at some point in the future.

Let’s take a look at a simple and also very common example.

In 1992, two different entrepreneurs got the idea to buy an apartment building in Vinohrady in Prague. At the time, buildings such as these sold for about 1 million crowns. From today’s point of view, this is a ridiculously small amount of money, as the value today would be closer to 100 million crowns.

However, at that time, buying real estate was not very common; rent controls were in place, buildings were in a very bad condition, etc. In this example, the first of our two entrepreneurs decided to buy a building for a company that he founded solely for the purpose of owning this property, while the second bought a building in his own name.

Driverless Metro Trains pragueIt is now 2020, and both entrepreneurs are 28 years older. They are already tired of taking care of the building, so they decided to sell the property. Both found a buyer who was willing to pay 100 million Czech crowns. During their period of ownership of the property, both businessmen had invested a total of 5 million Czech crowns in the buildings and also claimed depreciation of 3 million Czech crowns against the rental income.

Now let’s calculate how much each of the entrepreneurs will pay in taxes:

First, the entrepreneur who bought a building through a COMPANY

- Selling price: 100 000 000 CZ

- Tax value of the building in accounting: 3,000,000 CZK (comprising acquisition price plus appreciation, minus depreciation)

- For taxation: 97,000,000 CZK

- Business income tax (19%): 18,430,000 CZK

- 81,570,000 CZK remains in the company’s accounts after tax has been paid. The entrepreneur wants to use this money for their own purposes, e.g., to give some money to their children, pay for the reconstruction of the family house, travel abroad, etc. To use this company money for personal purposes, for example, to transfer it to their account and spend it on whatever they like, the entrepreneur must tax this amount at an additional 15%.

- Personal income tax (15%): CZK 12,235,500

- The entrepreneur will receive the following to his account: 69,334,500 CZK

- In total, they will have paid the following amount in taxes: 30,665,500 CZK

Now let’s look at the entrepreneur who bought a house in their OWN NAME

- Selling price: 100 000 000 CZK

- Natural persons in the Czech Republic are exempt from income tax on the sale of any property if they have owned the property for more than 5 years (for real estate purchased up to the end of 2020) or 10 years (for real estate bought from the start 2021 and later). So, the tax value of the building in accounting is not important for our calculation here.

- The entrepreneur receives the following to their personal account: 100,000,000 CZK

- Total taxes: 0 CZK

- The decision made by the first entrepreneur in 1992 to buy real estate for a company was a mistake that cost 30 million CZK.

The option to sell a business instead of real estate

It is important to say at this point that the entrepreneur who bought the building through a company could have opted to sell the company, rather than the property – the income from the sale of the company is also exempt after a certain period of time and therefore the matter would have been resolved.

While this is true to an extent, it is only partially true. They would not have received 100 million CZK from the sale of the company as they would have from the sale of the building, but probably significantly less than that. Importantly, the company’s buyer would have calculated that, compared to future rental income, he can only claim the depreciation of the tax value of the building in the accounting, which in this case is 3,000,000 CZK.

Whereas, if the buyer were purchasing real estate (not a company), they can pay almost the entire house purchagse price, i.e., CZK 100,000,000 CZK. In the future, the buyer will pay an extra 18,430,000 CZK (approximately) in taxes from the rent than if they had bought the property, and will therefore want a reasonable discount given this future tax burden.

In the majority of cases, the tax value of real estate held in companies is significantly lower than the current market value of real estate, mainly due to depreciation and rising real estate prices.

In conclusion

To reinforce the central point of this article – that long-term real estate ownership in the Czech Republic is far more advantageous when purchased under your individual name – let’s examine the case of Czech real estate tycoon Václav Skala’s acquisition of the iconic Dancing House (along with numerous other high-end properties).

Of course, Mr. Skala purchased these properties under his own name, including the Dancing House, for the sum of 360,000,000 CZK.

When Mr. Skala eventually sells the property, let’s say for 600,000,000 CZK, he won’t have to pay a single crown of income tax on his profit of 240,000,000 CZK.

In this article, I‘ll introduce you to the topic of commissions so that you have all the information you need when dealing with a Czech real estate agency.

I’ll guide you through what the normal amount of commission is in the Czech Republic, what it includes, and to who and when you need to pay it.

The commission charged by Czech real estate agencies and agents varies, and it is usually influenced by factors such as the property’s value and the confidence of the agency or agent. Typically, there’s a standard commission that’s considered reasonable. Along with the basic percentage, it’s important to account for the statutory VAT at 21%, which is added to the commission. So, if the commission stands at 3% + VAT, the overall commission totals to 3.63%, with 0.63% being the VAT portion. Here’s what you can generally expect in terms of commission amounts:

• Typically, for real estate valued between CZK 3,500,000 and CZK 15,000,000, the commission ranges from 3% + VAT to 5% + VAT.

• Regarding properties priced between CZK 2,000,000 and CZK 3,500,000, the usual commission is from 4% + VAT to 5% + VAT.

• For real estate valued between CZK 800,000 and CZK 2,000,000, the standard commission is 5% + VAT. It’s worth noting that you might encounter a minimum commission, such as CZK 80,000 + VAT.

• When it comes to properties priced up to CZK 800,000, you should anticipate a minimum commission ranging from CZK 50,000 + VAT to CZK 80,000 + VAT. In such cases, there might be a more limited range of real estate agency services available (such as homestaging or professional photoshoots).

At this point you may wonder whether it’s better to pay a higher commission or go with a cheaper real estate agency. There’s no one-size-fits-all answer here. It’s about people, and it depends on your personal preferences. You might find a real estate agent who offers a complete package, selling at a good price with a lower commission, such as 3% + VAT.

On the other hand, you might run into an agency that doesn’t offer great service but asks for a higher commission, more like 5% + VAT. So, it’s about choosing an agency that gives you the best value for your money. What really matters isn’t whether it’s 3% + VAT or 4% + VAT, but whether the end result is favorable for you as a seller – getting the best price for your property within a reasonable time.

What is included in the services of a real estate agency in the Czech Republic?

Here I will list the standard of services offered by a good quality Czech real estate agency:

• Understanding the seller’s requirements thoroughly to tailor the sale accordingly.

• Placing strong emphasis on preparation, including a price analysis, verifying tax implications, confirming legal status, assessing property modifications, and compiling a comprehensive property dossier.

• Implementing high-quality marketing strategies such as professional photography, homestaging, video and virtual tours, well-crafted floor plans, detailed descriptions, adding listings on major property platforms and social media promotions.

• Engaging effectively with potential buyers, conducting property tours with knowledgeable insights, maintaining professionalism, providing regular updates to the seller, and analyzing the progress of the sale.

• Reconciling the interests and timing preferences of both buyers and sellers.

• Facilitating a smooth property transfer, including secure handling of deposit boxes.

• Ensuring the smooth completion of the entire property transfer process.

The real estate agency should cover all costs with the sale, i.e. the seller should not incur any additional costs from the sale. The same applies to the buyer; the real estate agency should not transfer any costs to them.

Who pays the real estate commission in the Czech Republic?

The commission is usually paid by the seller, and that’s only fair. The seller is the customer of the service, they choose the broker and the broker acts in their favor. However, there are real estate agencies that have built their advertising campaign on the fact that the seller does not pay the commission. But beware, this is just a play on words.

The buyer has a maximum budget for the purchase, e.g. CZK 5,000,000, and they do not really care whether they pay CZK 5,000,000 to the seller and the seller then pays CZK 180,000 of it to the real estate agency, or the buyer pays the seller only CZK 4,820,000 and the real estate office 180,000 CZK. The costs for the seller will remain the same in both cases.

When is a real estate agency entitled to commission?

The right to a commission only arises after the whole transaction is successfully completed, which for the seller is the day they receive the money from the sale in their bank account.

Unfortunately, most real estate offices set this deadline earlier, e.g. on the day of signing the purchase contract. At that time, however, the property has not yet been paid for and the sale has not even been successfully registered with the cadastre, so this deadline is very premature. We recommend that you inquire about the term of entitlement to the commission before concluding the contract.

The KOTULA real estate agency has a commission of 3% + VAT on the sale price of the property. The commission includes all costs of selling the property, including quality marketing. The commission is payable only after the transfer of the property and receipt of the purchase price on the account.

We wish you the best of luck in choosing the right real estate agency for your needs. If you are thinking about selling a property, you can get in touch with us here at Realitní kancelář KOTULA, and we will be happy to assist you and guide you through the sale.

Are you selling a property and want to take the hassle out of the transaction? Put the sale in the hands of our experienced real estate brokers. At Kotula Real Estate Agency, we will guide you through the entire process and make sure you get the maximum amount for your property. Contact us!

Before you decide to sell an apartment, house or land in the Czech Republic, it is worth checking whether you will pay property sales tax. If you are not exempt from this tax, you may be surprised by the relatively high amount you will have to pay when you sell. So, what should you know about property sales tax, when it is payable, and in which cases you do not have to pay it according to Czech legislation?

Who pays the property sales tax?

In the Czech Republic, income tax on the sale of real estate is paid by the seller, unless he or she is exempt. An individual may be exempt under the conditions explained below. On the other hand, a company cannot be exempt and always pays income tax on the sale of real estate.

Are there exemptions from tax on the sale of real estate?

Yes, there are. And Czech legislation defines several of them. Income tax on the sale of real estate does not apply to you if:

- you have owned the property sold for more than 5 years (applies to property acquired before 1 January 2021) or 10 years (applies to property acquired after 1 January 2021). This is the so-called time test. Acquisition here means purchase, acquisition by gift, inheritance or any other way of acquiring the property. This exemption applies to all types of real estate.

- you have lived in the property for at least 2 years before the sale. This does not have to be a permanent residence, but it is sufficient to use the property for your personal living purposes, even occasionally. Importantly, however, the property must be a property that has been approved for permanent residence, i.e., it must be an apartment or a family home, not a studio or a cottage – these properties are not eligible for the exemption,

- you use the money you receive from the sale of the property to meet your own housing needs (purchase of another flat, house or land for building a house, construction of a house or renovation). However, this exemption option has several other sub-conditions and is quite complex, so we discuss it in more detail in the article How to use the money from the sale of a property to buy another property.

What is the amount of income tax on the sale of a property in the Czech Republic?

The income tax rate on the sale of real estate is 15 percent for individuals and 19 percent for companies. But beware! It is not 15 percent on the entire sale price, but on the difference between the purchase price of the property (the amount you bought the property for and the price you sold the property for). The tax is therefore only on the profit from the sale of the property, but even this can end up being very high given that property prices have risen exponentially in recent years.

What does the calculation of tax on the sale of a property look like?

If we wanted to illustrate how to calculate the tax on income from the sale of a property, the calculation would be as follows. You bought a flat for 3.4 million and sold it for 5.6 million, so you made 2.2 million CZK on the sale – and you tax this profit. If you had other expenses related to the sale of the apartment (furnishing the property, real estate agent’s commission, escrow, legal services, etc.), then you can deduct these from the profit and reduce your tax. For our model example, let’s set these partial costs at CZK 200,000. In this case, the basis for calculating the tax on the sale of the property will be 2 million. The 15 per cent tax will therefore amount to CZK 300,000.

If you are unsure about calculating the tax on the sale of a property, you can ask a tax advisor or an experienced real estate agent for help. You can also find help on the internet. There is a calculator for property sales tax.

How to pay tax on the sale of a property in the Czech Republic?

Tax on income from the sale of property must be reported on the tax return for the year in which the transaction took place. So if you sell your apartment, house or land in 2022, you must include this in your tax return, which you will file in the Czech Republic by 31 March 2023. This is also the deadline for paying the tax. You will file the return with the tax office to which you belong according to your place of residence.

Do I have to pay tax on the sale of an inherited property?

If you are selling a property that you have acquired through inheritance, several factors determine whether you will pay tax on the sale of an inherited property.

If the apartment, house or land is inherited from the testator in the direct line of descent (parents, spouse, children), then you must find out if the testator was exempt from estate sales tax, and if so, that exemption automatically passes to you. Thus, if you inherit an apartment, for example, from a parent who has owned it for 20 years, then he/she is certainly exempt (he/she has owned the apartment for more than 5 years) and therefore you can sell the apartment immediately after the inheritance proceedings are completed and you will not have to pay income tax on the sale of this apartment.

However, if you want to sell a property inherited from a testator who is not in the direct line, then the exemptions do not pass to you. To avoid the tax, your only option is to meet the exemption conditions yourself.

Do I have to pay income tax on the sale of a property acquired by gift?

Yes, the sale of a property acquired by gift is also subject to 15% income tax. Czech legislation treats donated real estate similarly to purchased real estate, so the only way to avoid the tax is to meet the conditions for exemption from real estate sales tax, as described in the answer to the exemption options. So, review these three exemption options to determine whether or not you will pay the tax.

If you sell a gift property, even if you do not meet the exemption requirements, you will calculate the tax in the same way as you would for a property you purchased. You just get an appraisal of the value of the property on the date of the gift instead of the purchase price, and you follow the same procedure as we described in our answer to the question about how the tax on the sale of real estate is calculated. It is important to add, however, that you are likely to run into the problem here that the price of the property according to the appraisal will come out slightly lower (usually 20-30%) than the actual market value of the property, and the income tax will therefore come out slightly higher than you expect. This is due to the fact that in the Czech Republic, forensic experts have to value the property according to the decreed prices, which are lower than the market prices.

Are you selling a property and want to take the hassle out of the transaction? Put the sale in the hands of our experienced real estate brokers. At Kotula Real Estate Agency, we will guide you through the entire process and make sure you get the maximum amount for your property. Contact us!

This article covers the most effective ways to search for properties to buy in the Czech Republic on the Internet.

Most readers will be familiar with the feeling of fatigue and frustration from long hours of often unsuccessful internet surfing.

If you follow the procedures below, you may not experience this feeling quite so strongly (I won’t give you a guarantee that you won’t experience it at all, I would say that it just comes with the search). A prerequisite for success is that we have a realistic idea of what we are looking for and for how much.

If you don’t, then even the process below won’t help you.

In the Czech real estate market, you basically have only two ways of searching. The first one is picking up on all the tempting news. The second way is to work with the so-called lagers. In the first way, we have to be quick, and sometimes we have to take no prisoners; in theysecond way, we have to be patient and be good negotiators.

Picking up the news

Set up a watchdog on the portals below and keep an eye on 99% of new offers on the internet. The watchdog is a feature that will email you newly published offers that match your requirements, so you won’t have to constantly scroll through several portals to discover the news, and you’ll save quite a bit of time.

It should be added that good news doesn’t stay on the portals for long, so without a watchdog, you have little chance of finding it in time before another bidder finds it and blows it away.

Set up such a service on these Czech portals:

- Sreality.cz, you can set it up here

- Reality.idnes.cz, you can set it up here

- Visidoo, you can set it up here

- Realingo (monitors 22 portals), you can set it up here

- Bezrealitky.cz, you can set it up here

Once you find a good offer, I recommend the following procedure:

Take action. Use the watchdog to be one of the first to know about new offers, take advantage of this opportunity, and act immediately. And I mean really right away – as soon as you hear about it, call the broker (don’t send an email) and ask for a viewing. Ask for the earliest possible date, don’t be afraid to go the same day, and cancel any other appointments. With well-priced properties, every hour counts.

Be decisive. Ask for a booking contract in advance and express your willingness to sign it very soon. On your own, study the data recorded in the land registry. Be prepared to increase the price by a little if you see that it might help you to get the property. You must remember that many other people will be interested in the advert and some of them will certainly be experienced buyers, so there is no time for indecision.

Go for a viewing. In the best-case scenario, you come to the viewing first, make an appointment and you’re done. But it may be that the estate agent or seller will do a viewing with all the interested parties, of which there will be no shortage, and hold an auction to get the highest price. In such a case, I recommend not to participate in the auction, as the price will usually increase significantly, and the offer will lose its attractiveness.

Working with lagers

A significant proportion of offers on the internet are lagers advertised for many months until the seller discounts to market level or meets a bidder who is able to agree on a market price, and we all have this opportunity.

The most common mistake we make is that we don’t go for more expensive than market-priced properties, because they don’t attract us. So, my tip is to cover the price with the advert and ask yourself “is this an offer I like?”.

If the answer is yes, go for a viewing. If you are still interested in the property after the physical inspection, it is your turn to negotiate the price with the seller.

Not every seller will want to negotiate with you, it will depend on their current financial and personal situation (and mood). However, I can say that at least 20% of properties will be negotiable. And that, in my opinion, is worth repeated attempts.

About Daniel Kotula

Daniel Kotula guides clients through the sale, lease or purchase of real estate in Prague already 14 years. It specializes in residential real estate, i.e. apartments, family houses, and land.

Daniel has in-depth knowledge of the entire real estate process, from preparation, through accurate valuation, attractive presentation, and negotiations with prospective buyers to the safe transfer of the property.

When he’s not spending time at work, he enjoys spending time with his family or making videos about interesting places, things and life in Prague for the popular YouTube channel Žit Prahu (Living Prague)