Václav Havel Airport in Prague is shortening the amount of free time allowed for picking up or dropping off passengers at the terminals.

Currently, drivers have 15 minutes to park, unload luggage, and say their goodbyes. However, this grace period will be reduced to 10 minutes starting May 2024.

The change comes after data analysis by the airport revealed that 90% of drivers can manage their drop-off or pick-up within a 10-minute window. “This adjustment will only impact a small portion of our clientele,” said Jakub Puchalský, a member of the airport’s board of directors.

For those who require more than 10 minutes, the airport will offer 15-minute extensions for 50 CZK in the P1 and P2 express car parks. This maintains the current total cost of parking for under an hour, as 30 minutes currently costs 100 CZK.

The airport is also investing in upgrades to improve the parking experience. This includes new barrier systems, license plate recognition technology, and additional cameras in the parking garage.

Additionally, Terminal 2 passengers will gain access to the PB Economy car park, which will be converted into a 70-space express car park in May.

It will increase the total number of express parking options in front of the airport to 350.

Would you like us to write about your business? Find out more

The Ministry of Foreign Affairs of the Czech Republic strongly condemns the decision of the Russian Federation to recognize the independence of the so-called Donetsk People’s Republic and Luhansk People’s Republic.

“This is a clear violation of the UN Charter, the Minsk Agreements and the Budapest Memorandum of 1994. After the illegal occupation and annexation of Crimea in 2014, this is yet another step by which the Russian Federation has long trampled on the fundamental principles of international law and its own obligations regarding the territorial integrity and sovereignty of Ukraine,” states the official website.

The recognition of the independence of the so-called people’s republics is another step in the escalation of the already tense situation and threatens the security of the whole of Europe.

“The Czech Republic, together with its NATO and EU allies, supports international diplomatic efforts to avert aggression against Ukraine and preserve peace. The Czech Republic will respond in unity with its allies. We reaffirm our long-standing, principled support for the territorial integrity and sovereignty of Ukraine within its internationally recognized borders,” said minister Jan Lipavsky.

“We call on the Russian Federation to reconsider its steps and return to the negotiating table in the interests of the security of the entire continent,” he added.

The Donetsk and Luhansk regions have been contested by Ukraine and Russia-backed rebels for years, with continuing violence despite numerous ceasefire agreements.

Analysts say that in the wake of the republics’ recognition Russia might send troops into eastern Ukraine under the guise of protecting its citizens.

Shareholders of Moneta Money Bank last month decided the acquisition of Airbank won’t happen this year. It was the second attempt to merge those two banks, however, the general meeting failed to reach a majority to support it.

Even though more than half of the present shareholders agreed with the acquisition of Airbank, they failed to reach the necessary 75% of votes in favor of the issuance of new shares. Issuance of new shares is necessary for the deal to happen in order to raise more capital for the new entity.

The acquisition was anticipated by experts, many of whom argued the new bank would increase competition in the market. While in general, decreasing the number of market players tends to worsen competition, Vladimír Staňura, adviser to the Czech Banking Association, argued in an interview for penize.cz that the new entity may put competitive pressure on the three banks that dominate the Czech market.

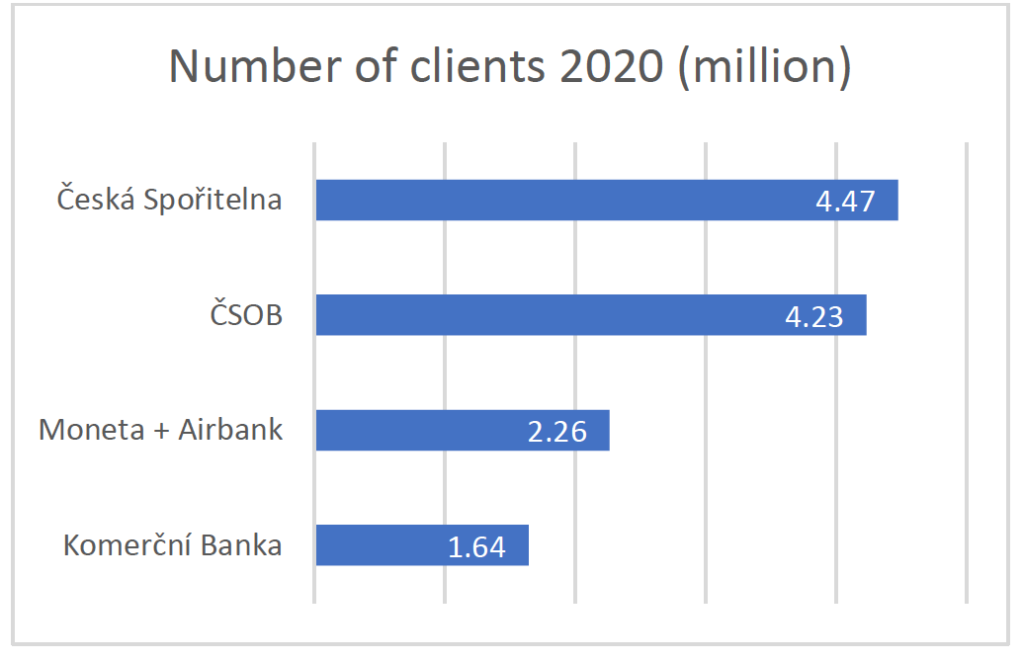

Indeed, the three largest commercial banks in the Czech Republic, Česká Spořitelna, ČSOB, and Komerční Banka have remained in their dominant positions since their establishment in the late 1990s and early 2000s. Many new players have since them attempted to challenge those three banks but none of them was successful enough.

The combination of the two medium-sized banks, Moneta and Airbank, would have created a third largest bank in the country by number of customers. The merger of such size would have been the first time in 20 years that the three largest banks would face a significant competitor.

Source: Finance.cz

What’s more interesting, and is not often mentioned by the experts, is that this new entity would be the first dominant player that is not an affiliate of a western European bank. By both assets and number of clients, the Czech bank market is largely dominated by affiliates of big foreign banks controlled from Austria, France and Belgium.

Even though the planned merger of Moneta and Airbank would result in significant foreign ownership, the case seems to be more complicated. PPF which is a Dutch group owned by the Czech Kellner family, would become the majority holder of the new entity.

Legally, the bank would have foreign ownership though some may argue that since PPF has Czech roots, the new bank would have been the first large “Czech” bank. Not just the Czech Republic but also other central and eastern European countries fail to produce bigger domestic banks.

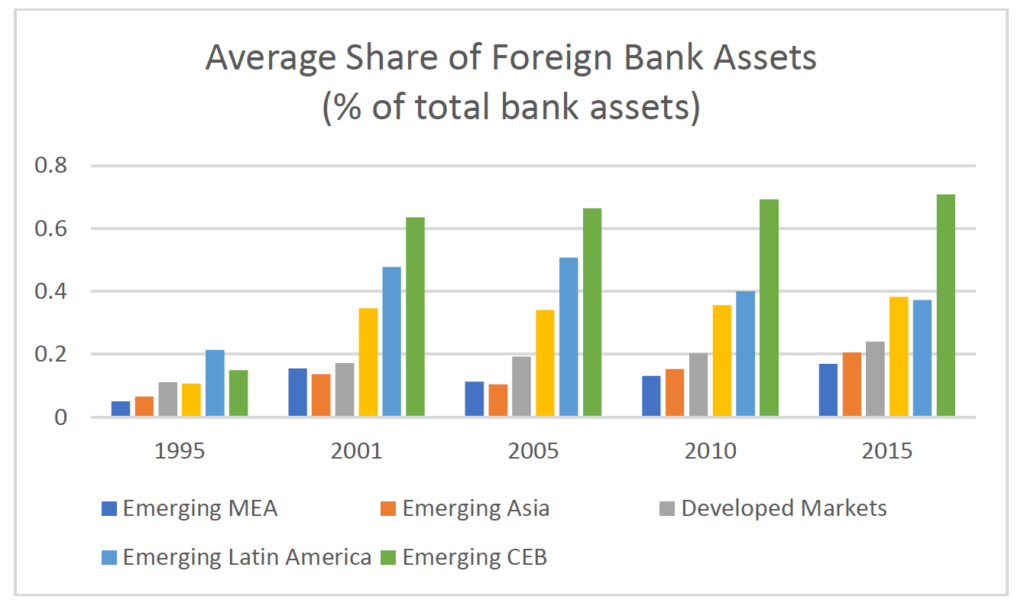

According to the WorldBank’s Bank Supervisory Survey, Czech Republic, Slovakia or the Baltics are among countries with the highest share of foreign bank assets in the world, all reaching above 80% of foreign bank assets as share of total bank assets.

In turn, the average share of foreign banks in the CEB region (Central and Eastern Europe + Baltics) is far beyond any other emerging and developed region.

Source: WB Bank Supervisory Survey, authors calculations

Foreign bank’s participation in Central and Eastern Europe was certainly beneficial in the transition to market economy. Their presence improved the external funding of domestic firms and arguably helped to channel further foreign investment into the region.

Nevertheless, it comes as a surprise that after more than 20 years of solid economic development in this region, very few Central and Eastern European banks have emerged to compete with their Western European counterparts.

Combination of Moneta and Airbank, even with Dutch ownership, could have resulted in a unique Czech bank that would take on the foreign giants. This is something that Tomáš Spurný, CEO of Moneta, seems to understand.

Even after two unsuccessful attempts, Spurný publicly claims he will continue to fight for this merger to happen.