How do you define what is a real property price? It surely is not what you see online on sreality.cz or other web servers. Most statistics you can find work with advertised prices, or the last known advertised prices of real estate, rather than the real hard data.

The real price for the purpose of this article is how much was the property really sold for, and for that, you need to go to the land registry.

Getting the data from the land registry can be done by anyone, however, it requires certain know-how and a visit to the land registry in person, via their website, or through other services like valuo.cz where you can purchase data on the real prices from your neighborhood.

Valuo has collected data for a few years now and compares advertised prices with actual prices from the land registry.

If you would have guessed the real prices are lower than advertised, you are correct. But by how much are they lower? It is common practice that real estate agencies set the prices a bit above the expected price of the owner just so that they have some room for negotiations.

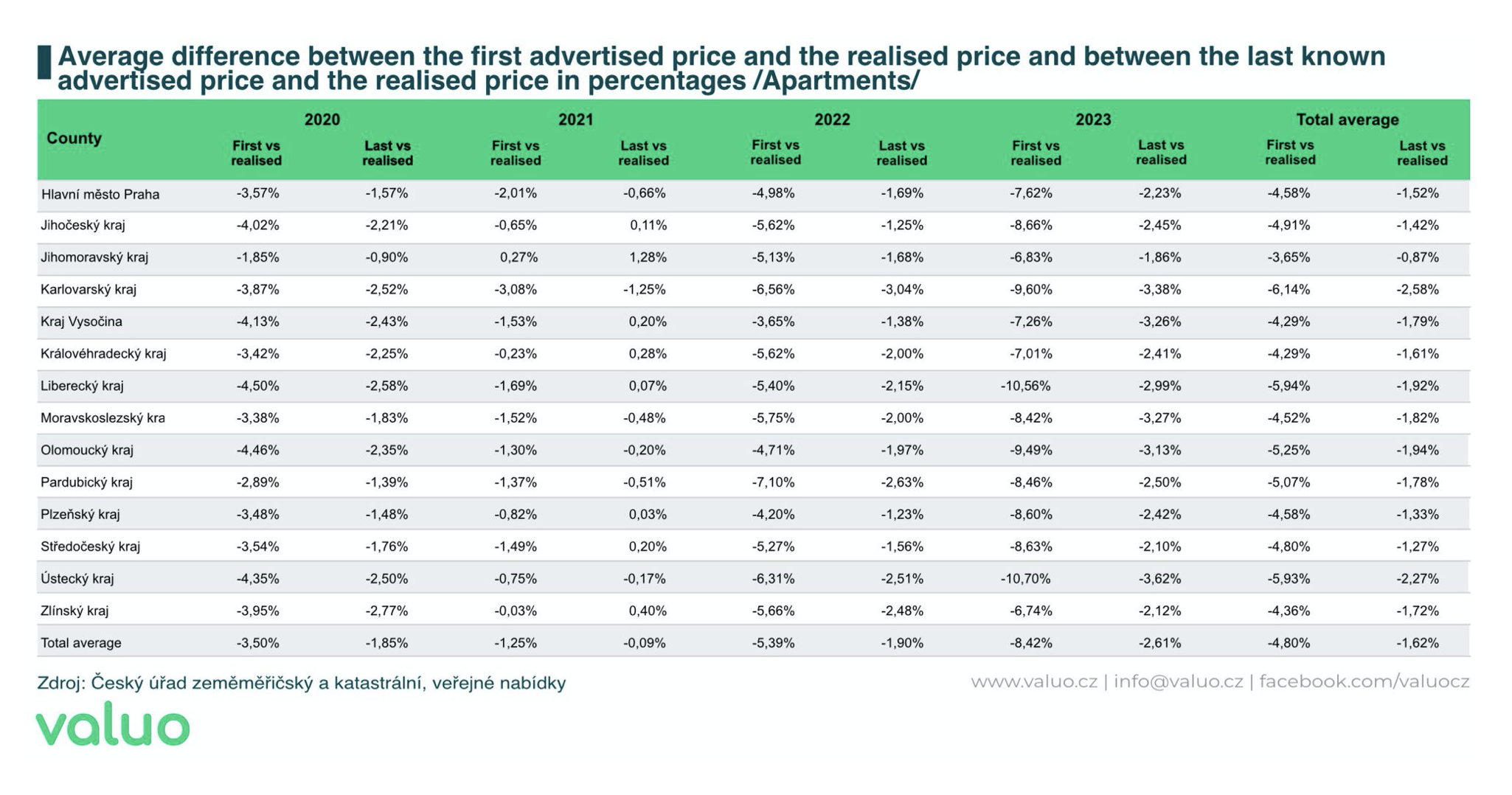

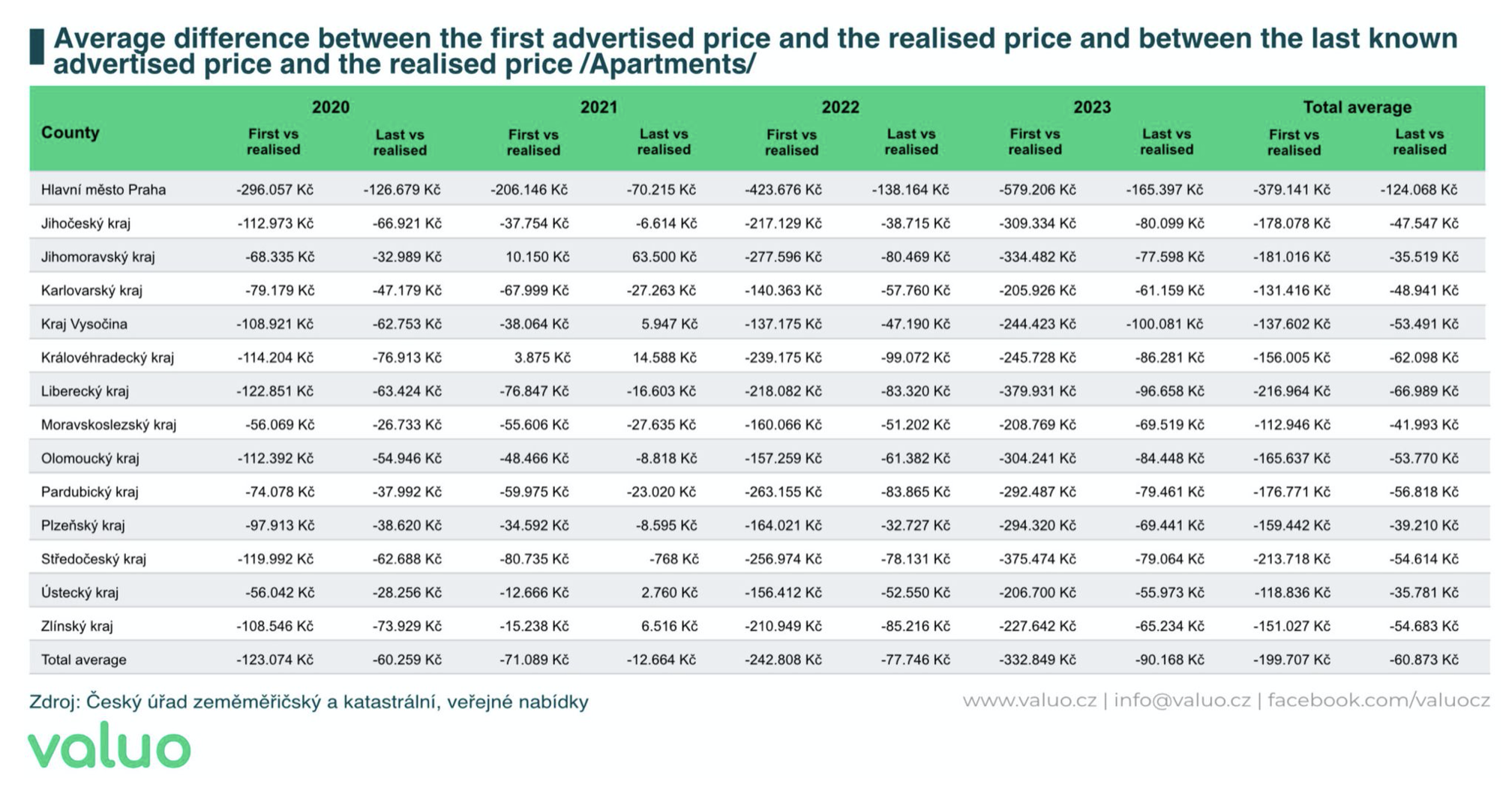

In recent years, the average difference is getting higher and higher, as you can see from the graph and information below. On average, in 2023, if we look at the first advertised price and compare it to the actual sale price (realized price), the difference is a staggering 579,206 CZK for flats or 7.62% in Prague.

This means if you see a flat for sale at 10,000,000 CZK, most likely it will be sold for 9,402,794 CZK. It’s important to mention that this is compared to the first advertised price. Agencies often reduce the price and if we look at the real price versus the last known online price, it is only 2.23% different.

Now of course this is an average so one should not take it literally, but this data shows you how the market looks right now.

In response to a regular question from our clients: “can we negotiate on the price”, these days I reply: of course.

It is still a buyer’s market, but watch out as the data is from 2023. This year, 2024, I can already see an extreme increase of buyers, leading to bigger competition, and presumably fewer discounts. I have even seen (again) bidding on some properties, as the market is getting hotter given the recent decrease in mortgage rates.

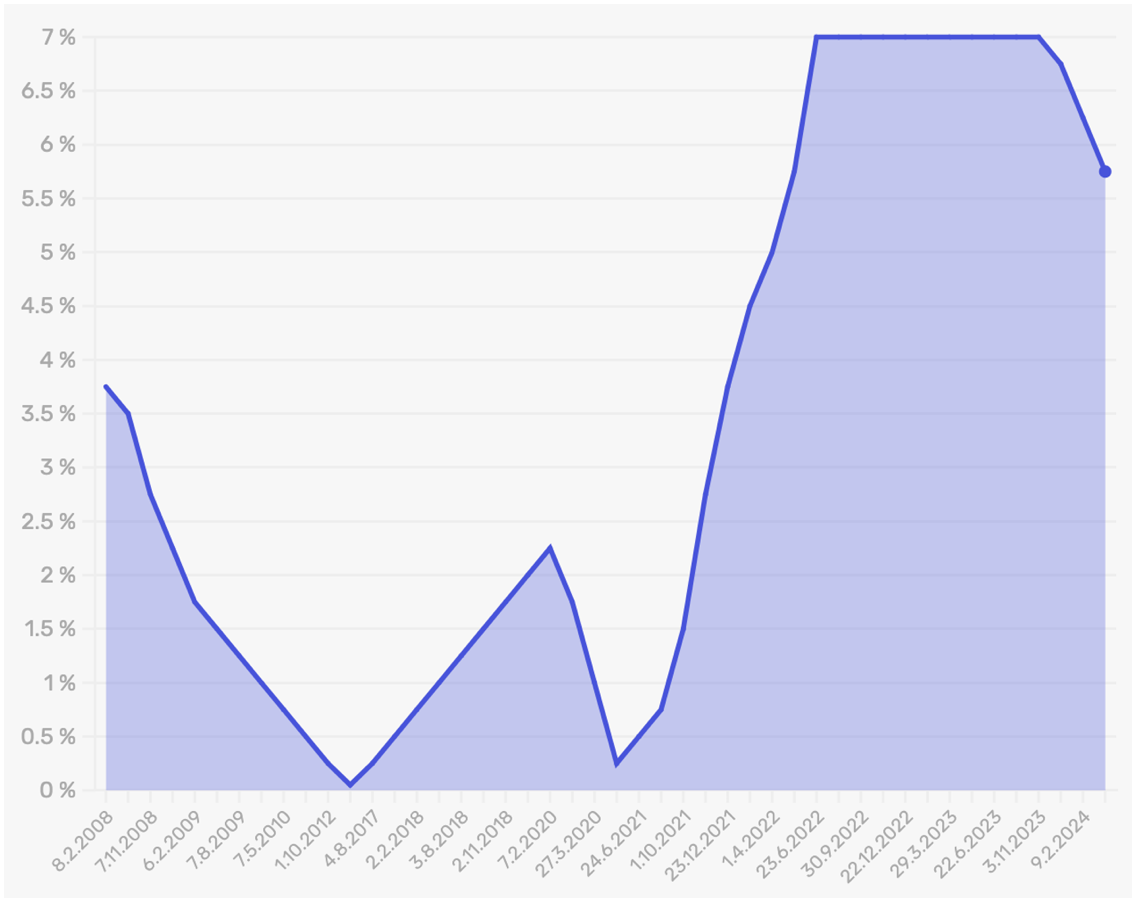

The Monetary Board of the Czech National Bank (CNB) has reduced the key interest rate by half a percentage point to 5.75 percent, reaching a level last seen in mid-June 2022.

Both the market and analysts were expecting a half percentage point decrease, so the Monetary Board’s decision should not have a significant impact on the exchange rate of the crown, stated Jakub Seidler, Chief Economist of the Czech Banking Association.

According to Seidler, a decline in interest rates can now be expected for both corporate loans and deposits, as well as mortgages.

“The central bank’s decision only confirms the established trend and market expectations, which have already been reflected in longer-term market rates. These rates began to decline at the end of last year due to expectations of faster rate cuts by central banks.”

From my point of view as a mortgage advisor, given rates have finally dropped under 5%, I think later this year the trend will surely continue. This will help revive the real estate market which, over the last two years, has experienced the lowest interest in a long time.

What is a bit surprising is the amount of interest in purchasing properties we are experiencing at the moment. If we compare it to four months ago, the drop is not yet that significant (no more than 0.5%), but we are having more than double the amount of inquiries which signals more and more people entering the market for purchases.

While the financial difference in repayments is not that significant for a 0.5% decrease, the reason is mainly psychological in my opinion, and FOMO – fear of missing out – on available properties, before they start increase in price even further due to cheaper mortgages.

Development of inter-banking rates since 2008:

Another piece of good news is inflation is now at 2%, which is the target value of CNB since 2010 and the lowest since 12/2018.

On the downside, savings accounts will promise lower and lower interest rates for deposits. Right now you can still find banks offering savings accounts with interest of 5-6%, but this will not last very long in my opinion.

Practical tip: A client approached me asking if they can pay back a part of the mortgage they took a few years ago. By the law, you can repay 25% of the original mortgage amount per year so yes, they can do that. However, their mortgage interest rate is 3%. From a mathematical point of view, it is more effective NOT to repay the mortgage now.

Just put the money into a savings account to earn interest and when savings account rates are lower than the mortgage interest, move the money from savings into the mortgage.

Would you like us to write about your business? Find out more

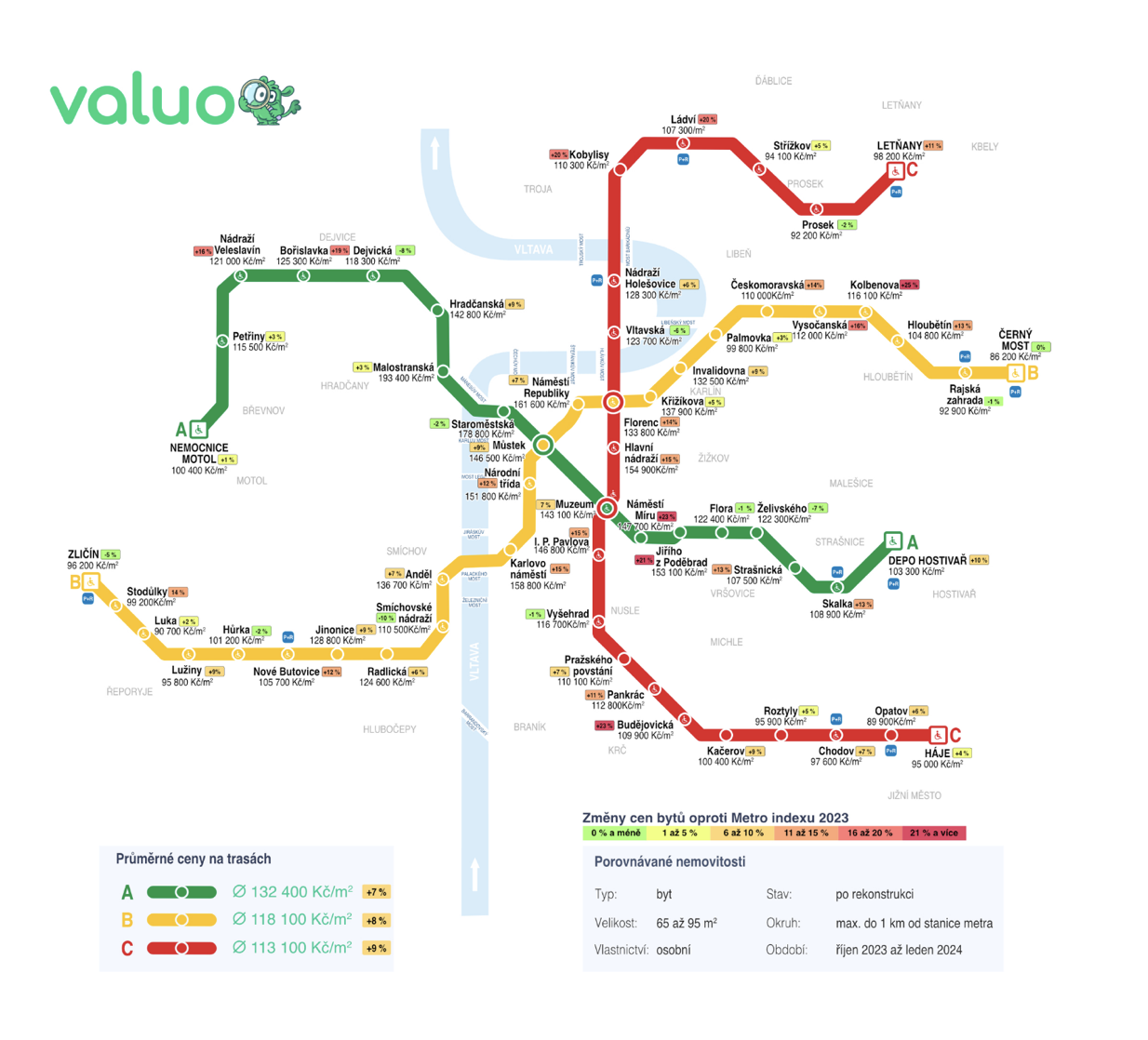

Over the past seven years Valuo, a company specialising in property valuation and related data collection, has meticulously tracked price trends within the Prague metro area.

Its efforts have revealed a remarkable 68% increase in prices along the green line (Line A), where figures soared from an initial 79,000 CZK/m² to over 130,000 CZK/m². This sustained growth highlights the unwavering demand for housing near metro stations.

Valuo’s analysis has been instrumental in providing insights into the real estate market. It focused on 80 m² apartments in personal ownership that have undergone full renovations. Leveraging data from finalised offers on real estate platforms, Valuo has offered a clear picture of the selling prices—a task not feasible with land registry data alone, which often lacks detailed information on the condition and floor area of sold properties.

In its selection, only apartments located within a maximum of 1km from the nearest metro station were considered. An exception was made for the Letňany station on the red line (Line C), which is less densely populated and therefore the radius was expanded to 1.5km.

Despite the uncertainties of 2022, 2023 showcased Prague’s resilience in maintaining high property values. According to Valuo’s findings, most locations around metro stations experienced price increases, though not quite reaching the heights of early 2022.

Highest Prices to be Found Along the Green Line (Line A)

Valuo’s data consistently shows that apartments near the green line fetch the highest prices. With an average price of 132,400 CZK/m², it stands as the priciest option, 17% higher than those around the red line (Line C). The most expensive properties are near Malostranská and Staroměstská stations, while the cheapest on this line do not dip below 100,000 CZK/m².

For those seeking more affordable housing, Valuo suggests looking towards Černý Most (the end of the yellow line, Line B) or Opatov on the red line (Line C), where renovated 80 m² apartments are available for less than 90,000 CZK/m².

The red line remains the most budget-friendly option, yet even here, average prices have seen a 9% increase year-on-year. The highest costs for housing along this line are near Hlavní nádraží, I. P. Pavlova, and Muzeum stations. In 2022, an 80 m² apartment near Hlavní nádraží would average at 10,732,000 CZK, while last year, the price rose to 12,390,480 CZK.

Valuo reports an average 8% price increase for apartments along the yellow line (Line B), with housing costs rising at 19 of the 24 stations year-on-year. The peak prices are near Kolbenova station, at 116,100 CZK per m². The city center remains the most expensive area on the yellow line, particularly around Náměstí Republiky, Karlovo náměstí, and Národní třída stations.

The prestige of living near one of Prague’s metro stations is unequivocally confirmed by the consistently rising apartment prices in these areas. Valuo’s analysis of 2023 sales data indicates the high mortgage interest rates have not deterred the sale of apartments in Prague. This trend is reflected in the prices near metro stations, which have mostly seen single-digit percentage increases year-on-year, contrasting with price drops in other major cities such as Ostrava, Olomouc, or Plzeň.

As long-standing collaborators with Valuo, we will continue to monitor and report on these trends.

Explore the evolution of apartment prices around Prague’s metro stations since 2017 through Valuo’s interactive map

On Thursday last week (February 8th), the Czech National Bank lowered the inter banking rates by 0.5%, to what is now the lowest rates since June 2022.

It was about time… In December, they lowered it 0.25% and now, with the lowering of 0.5% to the current rate of 6.25%, I think it sets a clear trend of lowering rates that I believe will continue until the end of the year.

What does it mean in real life?

Long story short, cheaper loans and less interest on savings accounts.

With lowering the rates, the Czech National Bank wants to stimulate the flow of money into the economy, rather than encouraging people to let money sit in a bank account or avoid borrowing due to high interest rates. Lowering rates should mean the opposite to stimulate the economy

Did the interest rates already drop?

No, not yet but we can expect it very soon to happen. Right now (as of 13.2.2024) you can still find savings accounts which provide more than 6% on savings but I suspect it will not last for very long.

Similarly, mortgage banks haven’t reacted to this recent lowering yet. It typically takes a few days or weeks for the banks to update their offers but again, I think we can expect lower rates soon.

However, don’t expect an immediate 0.5% drop since the cost of mortgages is dependent on more factors than just this 2W Repo rate from CNB.

We have already seen in February that mortgage rates did indeed go down to an average of 5.6%.

source: hypoindex.cz

What will happen to the property market?

In theory, the equation is simple, when rates go down, it is easier to borrow money and if the economic situation in the country is good and people feel secure, the demand for properties increases. If there is enough supply of affordable properties, it is not a problem.

If there is generally a shortage of flats, and we can argue that this is the case in Prague, I think you can imagine what might happen again to the property prices. Mortgages at 5% are still relatively expensive (compared to the last 10 years in the Czech market), but it is clear from the increased amount of inquiries that 2024 will definitely be a stronger year than 2023 in terms of property sales.

And maybe, we will see another year of appreciation of properties.

Unless something unpredictable happens again…

Owning property in Prague or the Czech Republic is the goal of many.

To live in a city with such a rich history, beautiful architecture, work opportunities, and safe and clean (mostly) environment is surely very nice, but once you accomplish this dream, you might ask “What’s next”?

Then you remember a holiday destination in the Canary Islands, or a house in Croatia, perhaps a flat in your home country, or maybe property in Spain or France? If you do not have the cash to pay for it from your own sources, the logical question is “Can the bank pay for it”?

The answer is YES, but… Czech banks will not use properties abroad as mortgage security or collateral since they do not understand the local laws and can only help if you can provide sufficient collateral here.

Let me work with the basic assumption, that you are financially stable with above-average income, you already bought a property in Prague a few years ago, and you know what you are doing. I will also not discuss the investment potential of these holiday homes, since that is another topic to be covered and probably not by me. Let me explore how the bank can pay for your holiday home for you.

There are a few ways. Actually Four that I know of.

Option 1 – Releasing equity via American mortgage. This is the simplest way to get money from your property for further investments. American mortgage (not to do with the continent, just a Czech term!) it’s is a type of loan where the bank does not care too much about how you use the funds.

Assuming you have enough value in the property, banks can typically lend you up to 70% of that value with which you could buy a holiday home abroad. The downside is that American mortgages typically have a higher rate and shorter duration.

Option 2 – Releasing equity via regular mortgage. There are a few banks out there that can take your current property, grant a regular mortgage, and allow you to send the money abroad. It is a very tedious process with a lot of paperwork, but it is possible.

You would need to show the purchase contract for your new holiday home and similar to the way it transfers money here, the bank would send the money abroad.

Option 3 – Buying property in Austria There is one bank that accepts collateral in another country, an exception to what I wrote before. That is if you are buying in Austria. You can buy a property, without security or even owning a property here at all with 70% financing.

We would be speaking typically about the mountain apartments or houses for skiing and that is doable with financing from the Czech Republic with no previous collateral here.

Option 4 – Personal loan The last option is simply to borrow the money via a personal loan. On one personal loan, you can typically get max 1m CZK, in some banks up to 2m CZK with a relatively short duration of 8-10 years, so watch out for higher repayments. You might need to combine loans from a few banks too, in case the property is a bit more expensive.

Please consider all purchases responsibly. Having a property abroad can also come with downsides in the form of property management, local laws and regulations, selecting the right property and agency, and many more. While we cannot help with selecting the properties, if you would like to discuss the financing options, as always we would be glad to be of assistance.

About two years ago, buying a property was quite challenging. If you were looking to purchase a property then, you might remember there were often multiple interested parties and most properties were sold very fast, often resulting in bidding wars.

I believe now we are seeing signs that we could be returning to that situation.

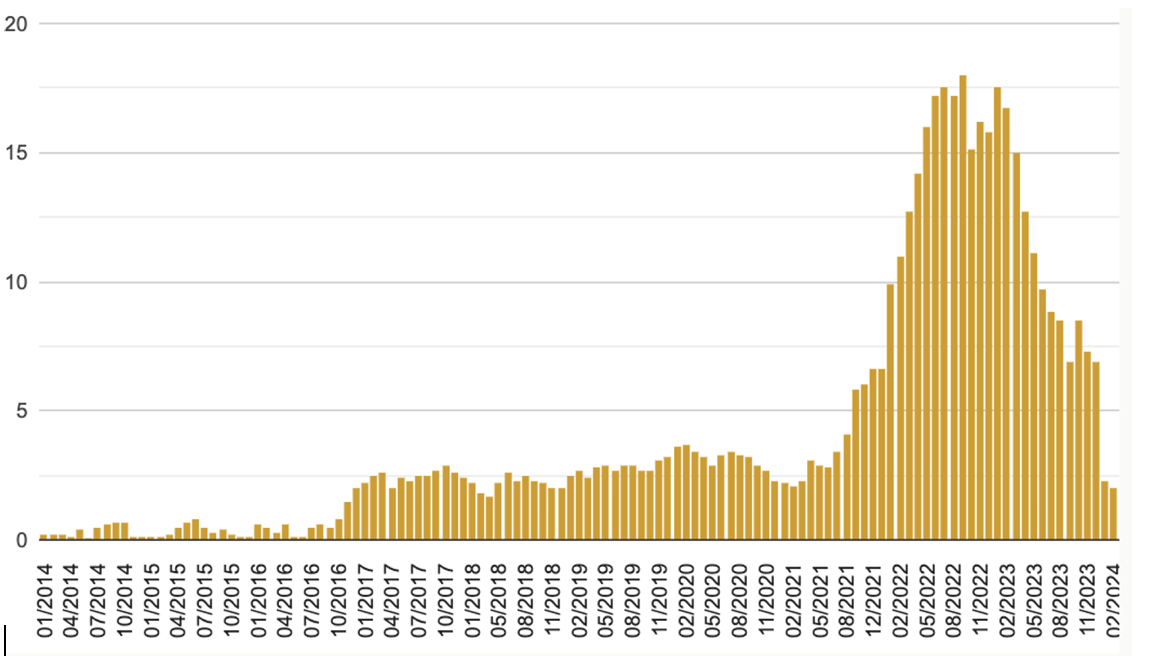

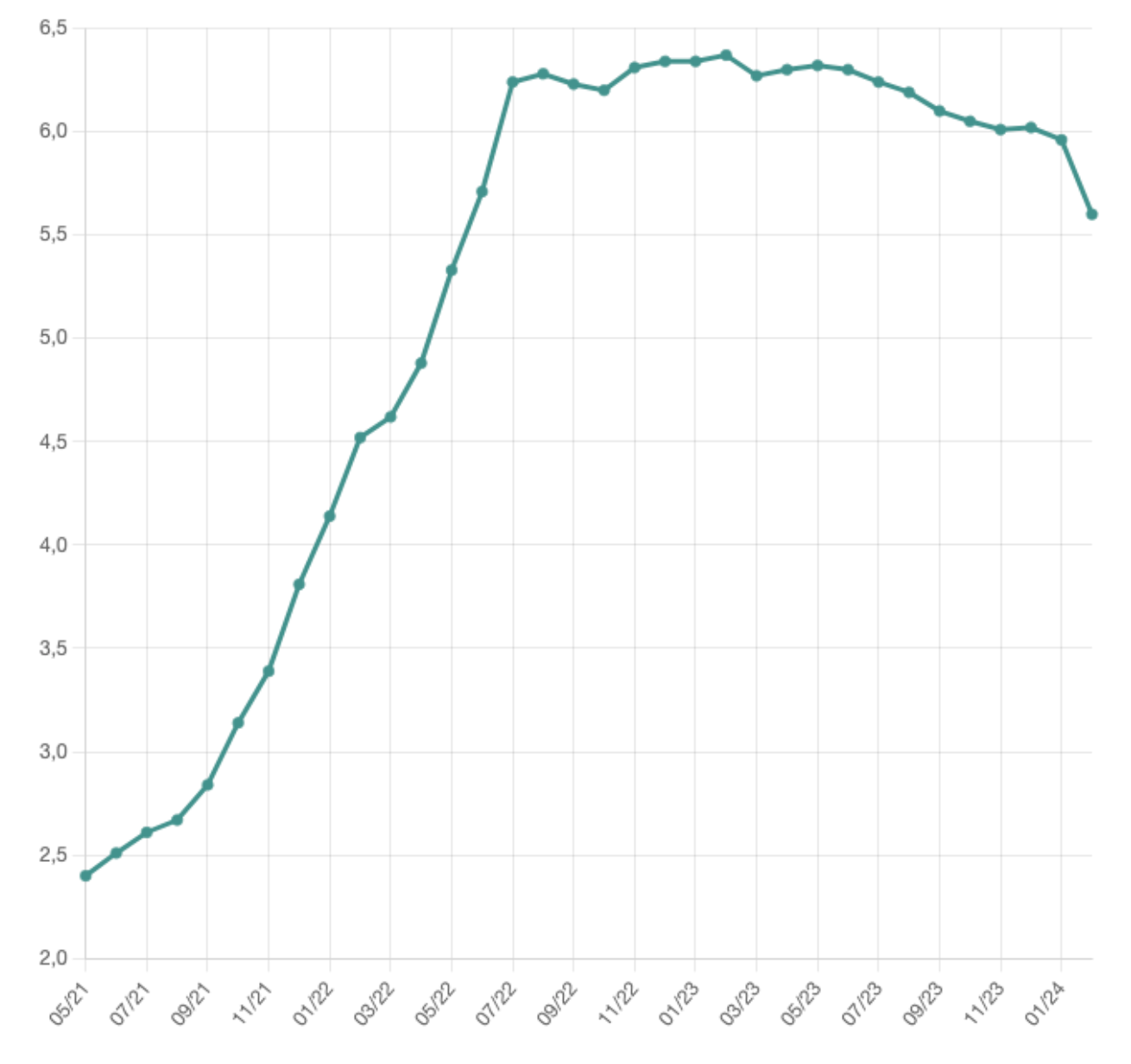

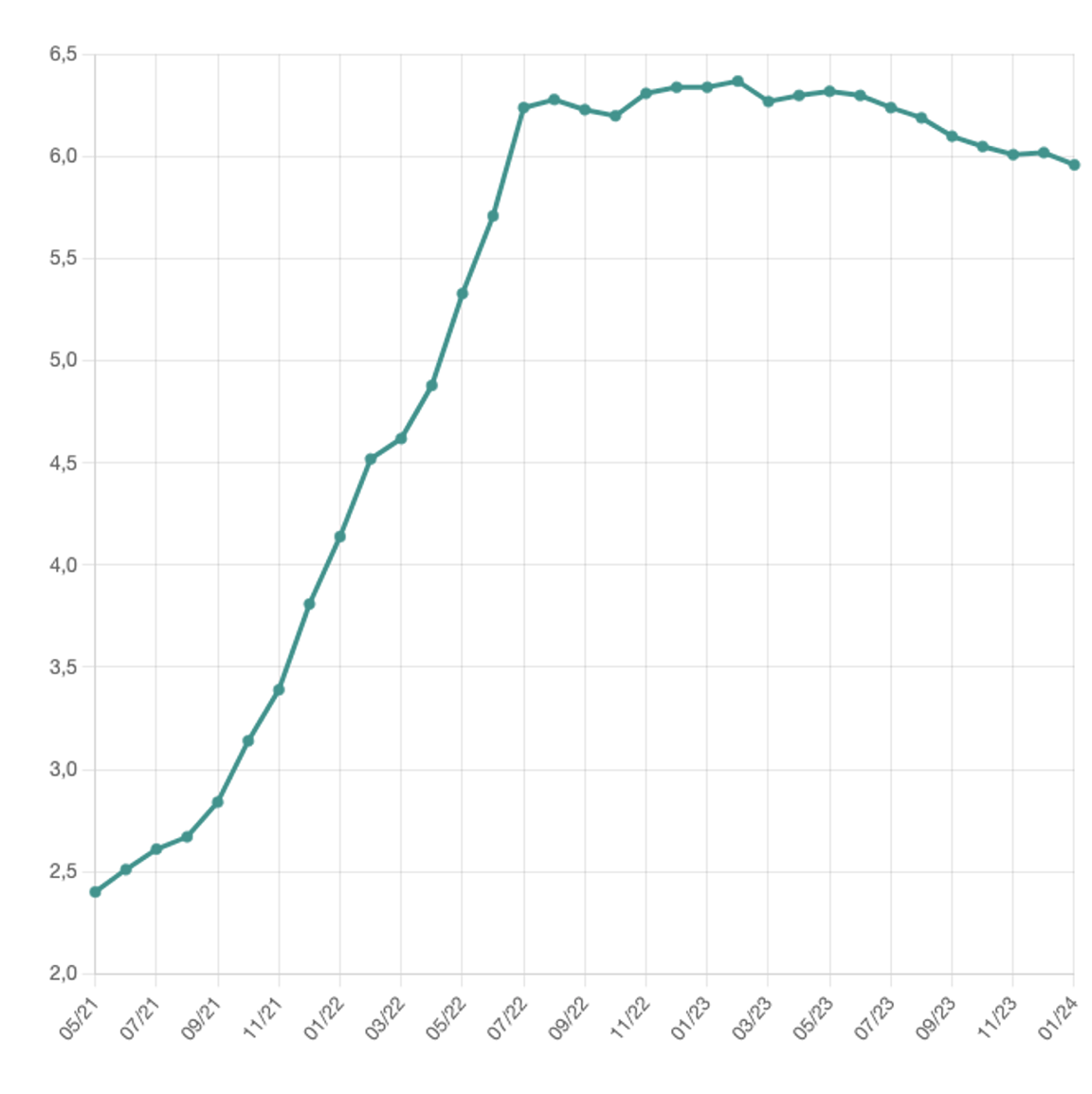

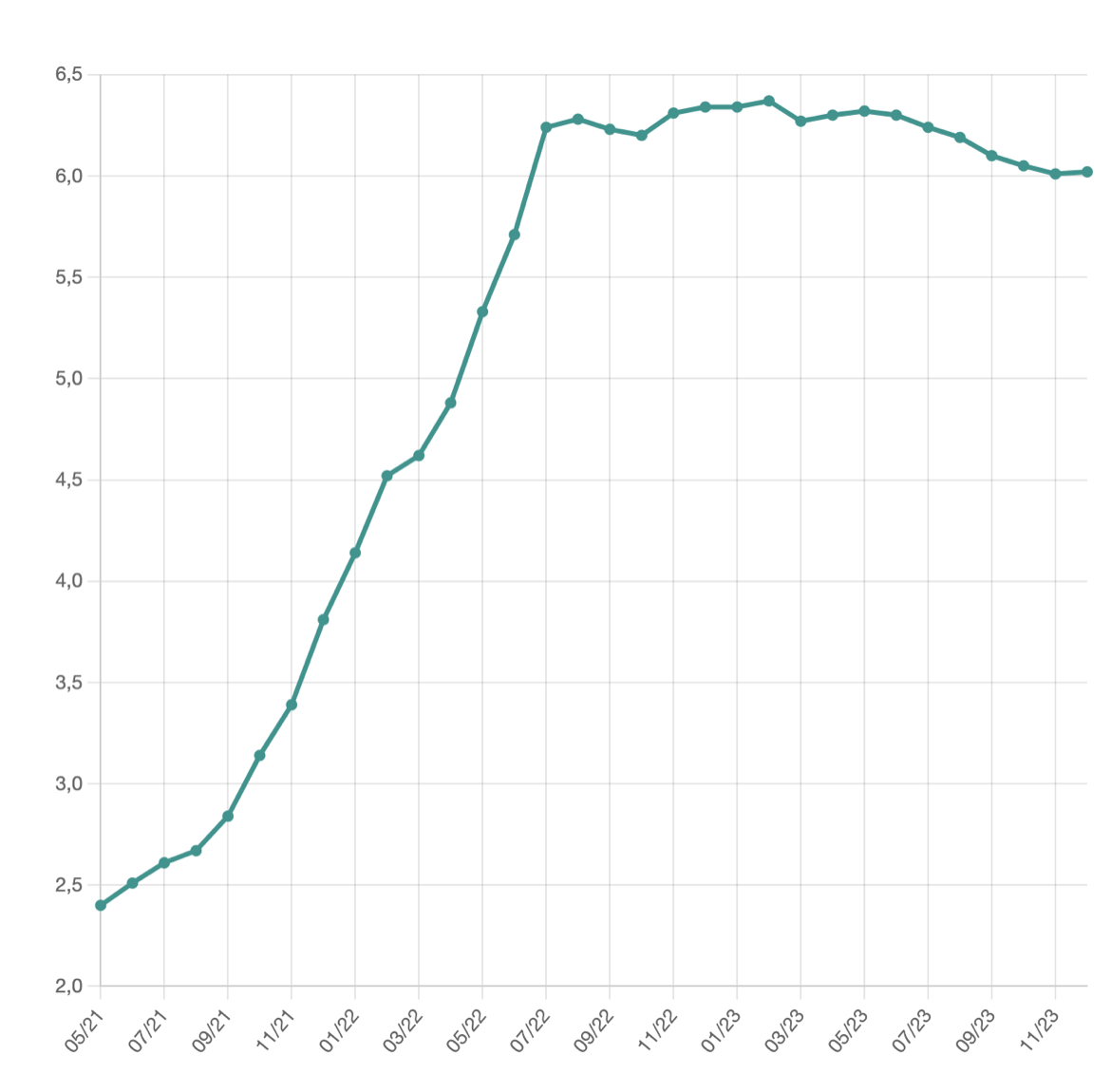

The main reason for the drop in real estate transactions in 2022 and 2023 was the soaring interest rates. The Czech National Bank (CNB) increased the rates during 2021 and 2022 and banks followed with increasing mortgage rates, which is best shown in the graph below.

Source: average offering interest rates on all fixations by hypoindex.cz

As a direct result, there was a massive reduction in mortgage production. Some months saw a drop of 80% year-on-year! This in turn led to significantly fewer property purchases and many regions suffered a drop in prices. At some point, prices were down 20% in areas such as Cerny Most in Prague, or Ostrava.

The reason for this was simple: People who needed mortgages to purchase a property were thinking about the costs of the monthly repayments. If the rates went up from 2% to 5.5%, for example, monthly repayments increased by roughly 50%.

For the same mortgage, instead of paying 20,000CZK, you repay 30,000CZK. People who had their fixation periods ending at that time were up for an unpleasant surprise, though luckily not as bad as in some countries where floating rates are standard and therefore no protection when the national banks increase rates. At least in the Czech Republic, we have rates fixed for a certain period of time so borrowers can plan their cash flow accordingly for the next couple of years.

Now what is really interesting is though we are only in the third week of the new year, I can personally confirm more than triple the amount of inquiries for property purchases compared to December! After checking with other mortgage advisors, it’s clear that after a long time of waiting, many people decided to go ahead and explore the real estate market again.

What is the reason for this massive increase? For now, we do not have the data just yet so I can only speculate…

- In December the Czech National Bank lowered the inter-banking rate by 0.25% from 7 to 6.75%. This is only a minor decrease but it clearly sets the new path of future lowering of interest rates. I would not be afraid to estimate that by the end of the year, mortgage rates would be close to 4% or maybe, maaaaabye even a bit below

- The psychological factor at the beginning of the year. Many of us have New Year’s resolutions and buying a property can be easily one of them. While January is typically one of the calmer months, this year it is definitely not the case

- FOMO – or fear of missing out. When you know the rates are high and people were not buying for a while, combined with lowering prices in some areas, and maybe some people were thinking of this as a great opportunity to invest and leverage the market position of buyers. When the rates start to go down, in theory, that can lead to an increase in prices again so it might be a good time to look into this sooner rather than later. This rationalization could be on their minds.

To sum up, I would be very curious how the next few months go and whether the CNB will keep on lowering the rates, or whether this surge in buying interest is just a January thing and it will lower again. If this pace will continue though, we are up for some interesting times.

Earning income of a rental property is a popular form of passive income. If you, as an individual, are involved in long-term property rentals, taxation can be quite straightforward. In the right circumstances, you might not even need to pay tax on this income.

However, income from short-term accommodation rentals is always considered a business activity, subject to stricter regulations, and often incurring higher taxes than income from property rentals.

How to Determine if Your Rental Activity is a Business?

The Income Tax Act defines so-called rental income and applies taxation when you, as an individual, engage in the long-term rental of your own property. For this income, you can either apply a flat 30% cost deduction, or actual costs. If your income exceeds 20,000 CZK per year, you must file a tax return.

Any other form of property rental, such as providing accommodation services, is considered a business activity and requires a trade licence and compliance with other state-imposed conditions. This includes properties held as business assets, short-term rentals, or using platforms like AirBnB and Booking.com. These activities are identified by financial authorities as business operations in the accommodation services sector.

Tax Returns: A Mandatory Requirement

If you rent out a property, you are almost always required to file a tax return, even if you are employed and your employer usually handles your annual tax settlement. If your rental income exceeds 20,000 CZK for the tax year, you must file a tax return independently. You are not required to submit income summaries to the Social Security Administration or your health insurance company for rental income.

However, if you’re in the business of providing rental services, such as short-term rentals for tourism profits, you must file a tax return as a self-employed individual (OSVČ). This income cannot be taxed under Section 9 of the Act as rental income, but only as business income under Section 7. As a business, you are also required to submit income summaries to both the Social Security Administration and your health insurance provider.

Tax returns for the year 2023 are due on the Tuesday after Easter, which is April 2, 2024. You are also required to pay any owed income tax by this date.

Real or Flat-Rate Costs for Rental Income?

A major benefit of long-term rental income (taxed under §9) for individuals is the possibility of not paying income tax. While you can apply a flat 30% cost deduction, this will still result in some income tax. Using actual costs can be more advantageous, allowing you to deduct property depreciation and even flat-rate automobile expenses, often reducing your taxable income from property rentals to zero.

Tip: For example, if you have a mortgage for your rental property, you can claim the paid interest as a real cost, thus reducing your tax base.

Rental Income from AirBnB

In the business of accommodation services (subject to §7 rather than §9), you can also use flat-rate costs, which are more advantageous at 60%. Real costs can be applied as well. You must file a tax return and submit income summaries to both the Social Security Administration and your health insurance provider. Alternatively, you can opt for a lump-sum tax, which exempts you from filing tax returns and income summaries. If your turnover exceeds two million CZK in 12 months, you must register for VAT.

In conclusion, the Czech banking system is quite easy going when it comes to rental taxation, since in the vast majority of cases you can bring your taxable income to almost zero. For AirBnB income, the 60% expenses are also very handy but you need to also pay extra on health and social.

Almost two years ago, the Czech National Bank (CNB) introduced three regulating parameters to limit how much the banks could lend customers (DSTI, DTI and LTV), which essentially considered personal debt and income against the mortgage value.

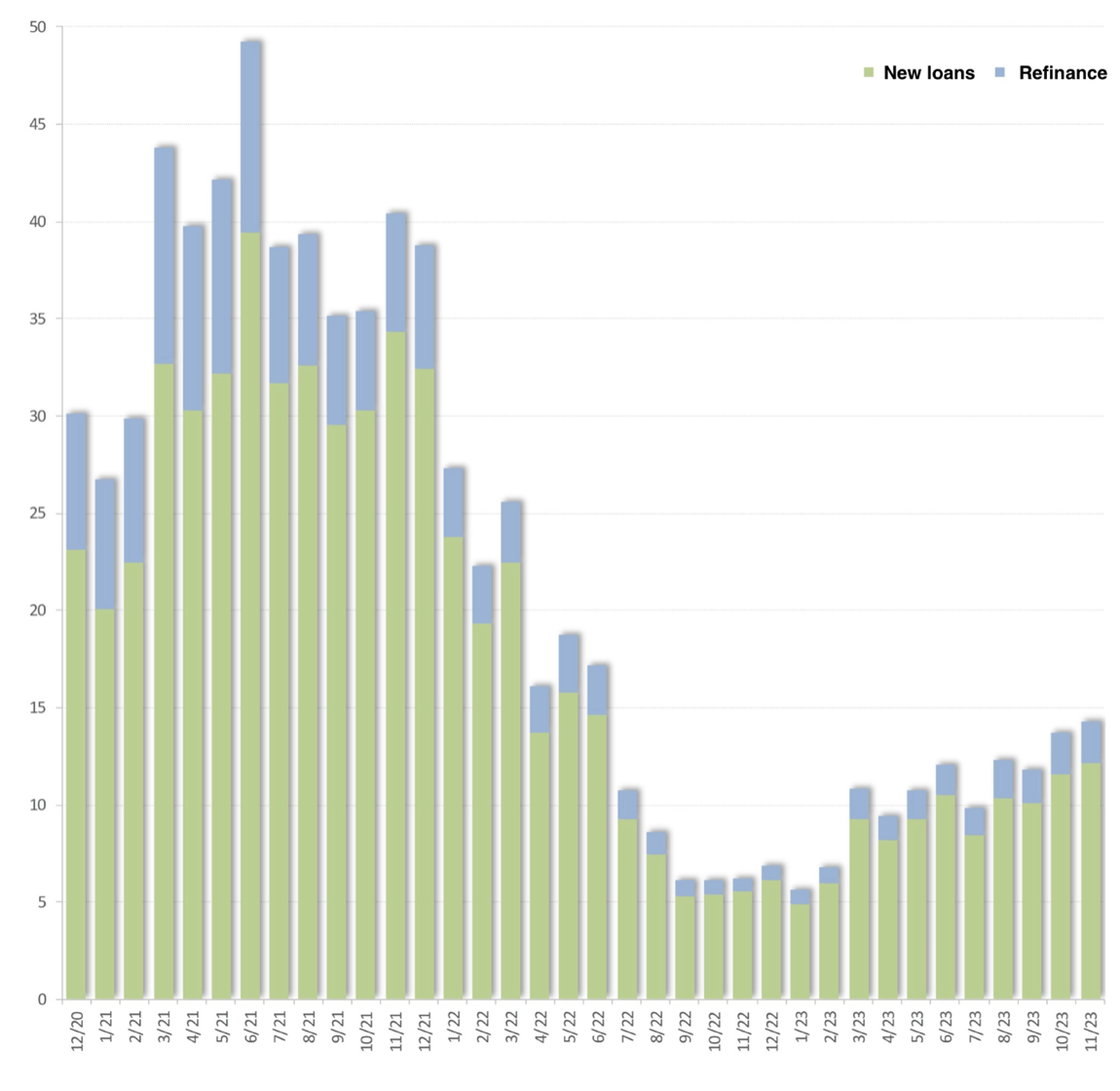

This, along with increased mortgage rates, really slowed down the amount of mortgages taken out recently. At one point last year, the amount of new mortgages were down 80% year-on-year, more on this below!

Now the CNB is removing the second regulation, DTI, or debt-to-income, on the banks meaning they could lend even more money to customers.

In all, I think it’s fair to say the mortgage market has gone through some crazy development.

To describe how low the mortgage market was a year ago, if we look at November 2022, 84% less mortgages were approved than November 2021. Minus 80% on production, that is quite something! Can you imagine your business revenues would go down this much? Banks were not having the “easy” times back then – but who would pity the banks, right?

However, if we now compare November 2023 with November 2022, there is an increase of mortgages approved. More than +120% in fact! How is that possible?

Source: www.gpf.cz/hypotecni-uvery-prosinec-2023

According to hypoindex.cz, last year in November the average offering mortgage rate for 5Y fixation was 6.07%. This year it is only slightly lower: 5.81%, so how come there are more than double the amount mortgages when the rates are essentially the same?

Average offering rate by hypoindex.cz

My answer is, it’s mainly a psychological effect and people started to see more investment opportunities around.

The best rates these days are around 5.19% and people simply started to get used to higher rates.

Besides that, 5-6% rates are nothing extraordinary if we look to other countries. In the Czech Republic, between July 2021 and July 2022, rates increased from 2.5 to 6% within 12 months.

That was the fastest increase in the recent history which caught most of the market off guard. People started to reconsider whether it is still viable to put money towards property investments while rates were close to 6%, while others did their refinancing way in advance to avoid something like a 50% increase on repayments.

If your mortgage had a rate of 2.5% and you increased to 6% during this period of time, then your repayments effectively increased by 50%!

As a mortgage advisor I confirm increased interest compared to a year ago, that is for sure.

How does this new deregulation impact the market now?

Not much – that is my expectation. Banks used to have limits for maximum borrowing compared to monthly net income of the household, usually up to 50% of net income. This regulator is called DSTI (Debt Service to Income) and was already removed months ago.

Now the ČNB is removing DTI – total Debt to Income – which was around 9.5 times the annual net income. Last regulation in place is the Loan-To-Value (LTV), which is set at 80% or 90% of the property value, depending on the age of the applicant. Typically only those ages 35 or below can get 90% but of course, there are always exceptions.

Can you borrow more money from the banks now?

Theoretically yes. But in real life, not yet. Banks need a bit of time to adjust to this new rule and it is quite possible they will keep strict rules themselves to prevent customers from overborrowing.

Basically, while the CNB might not enforce these rules anymore (DSTI and DTI), banks can internally decide to follow them nevertheless to limit riskier lending.

Oh, and I suspect property prices will slowly start to grow again, as long as the rates keep coming down. Slooooowlyyyy…

To close up on the year, I would like to share a few exceptional expat mortgage case examples that might seem impossible to get approved, yet actually were.

Less than 6 months in the Czech Republic and 100% financing!

For the first story, we have to travel back in time to 2015 when a couple from another EU country decided to move to the Czech Republic in the middle of the year. Soon after, they heard that 100% financing was possible. They were looking to purchase a family house in Kralupy and boy did they get a good deal!

For less than 3.5m CZK, with no down payment, and after just a few months in their new jobs in Prague, they got everything paid by the bank… Sigh… Good ol’ times. For those of you perhaps new to the mortgage market in the Czech Republic, though this couple was able to get 100% financing, it is not possible now. Currently, it’s capped at 90%.

Business owner with minimum income, yet a 10m CZK mortgage was easy.

Being a business owner is challenging and rewarding at the same time. The challenge comes from financing, as very often company owners pay themselves a very low salary, or none at all. This was the case of our client two years ago. He had a successful IT company and the business was doing great. However, to save on taxes, he paid himself a small salary.

Would that be a problem for a mortgage? Normally yes, since the mortgage amount is directly dependent on how much income you have. However, there are two banks that consider company turnover, rather than your personal income, as long as you are a majority shareholder or owner of the company. Since the company was doing great, no one cared that the official salary was too low and the high mortgage was approved based on the company numbers.

Lawyer ran away with the money, yet the flat was purchased.

We already covered this in our previous article but it was such an extraordinary event (with a happy ending though!) that I need to mention it again.

Imagine that you send money to the seller to pay for the purchase of a flat and then you hear in the news that the lawyer misused the money and was caught by the police, just before leaving the country. It didn’t help much, the money was gone. Even today there is about 150m CZK still missing! Part of this is from our client.

The deal was saved though. How, you ask? We were lucky since we didn’t send all the money at the same time and also that the purchase contract was structured so that upon paying the agreed amount into the escrow account, it was considered paid. Because the money was misused after it reached the escrow account, we fulfilled our condition and in court, we would win the case. Ufff, this one was close.

Project miracle financing

There were clients who were living in a family house that they wanted to purchase. Unfortunately, they didn’t have the 10% down payment needed, only about 5%. How did we solve this? No – we didn’t take a second loan to cover the difference.

Instead, we went to the bank and without telling them the purchase price, we let them conduct their official valuation. It came above the asking price! The clients negotiated down a bit and viola, a completely clean purchase of a family house with less than 5% down payment, only because the valuation went so well.

25% discount for property

Two years ago, I was approached by a couple who wanted to purchase a property they lived in. It was a flat in Malá Strana, before the renovation, about 56m2, and the owner wanted to sell it to them. They had a 10% down payment but the owner wanted 10m CZK for the flat. We thought that was really too much so we ordered a bank valuation and it came at 7.5m CZK, a bit more of a realistic price for sure!

But what now? We could go only to this one bank and the owner wanted 2.5m CZK more. We played the only card we had the valuation. The clients wanted to purchase it, but they really could not pay more than the bank valuation since we were limited by the 90% financing. And guess what – the owner agreed with 7.5mbCZK! I couldn’t believe it myself!

The clients actually needed six more months to save up to the 10% needed so they signed a future purchase contract securing the deal and completed it later the next year. It was clear that the owner just shot the 10m CZK from the blue sky, just testing us – and luckily the bank valuation played in our favor.

So there you have it, five miracle property purchases that at first might have seemed impossible but in the end worked out. Of course, there are always hard cases and they don’t always work out, but as long as you know all the avenues to try, sometimes they do end in success.

About 50% of property purchases are made with the help of a mortgage, despite relatively high-interest rates of around 5.5%.

However, just because a bank has agreed to give you the mortgage, doesn’t mean it’s all smooth sailing from there.

When you have financing from a bank, once the mortgage is approved, you should make sure you completely understand the mortgage contract so as to avoid any potential issues.

Because I have been helping foreigners with their mortgages for the last 10 years, I would like to share a few tips on what to watch out for, BEFORE the mortgage is signed.

Drawdown conditions

Once the mortgage is approved, the bank will set a list of about 5-10 conditions you still need to meet after signing the mortgage and before it actually sends the money. These lists typically consist of:

- Deliver the bank-signed pledge contract (with verified signatures) for the property to the land registry

- Deliver the bank-signed purchase and escrow contracts

- Prove that you paid the down payments from your own finances, not from another loan

- Take out insurance for the property and show the confirmed payment

- If the seller has a mortgage on the property, get confirmation from the seller’s bank about approval for sale and the calculation of how much money needs to be paid to close their mortgage

- Other conditions depending on the client or property could include, for example, an occupation permit for the development.

Usually, the drawdown conditions can be met within one to three days after signing the mortgage and then you fill the drawdown order, typically online or, in some banks, on paper.

For those of you who are self-employed, you might also need to show confirmation of your debt status from the financial office which can take weeks to get so make sure you get it in advance if it is the case that your bank will want it.

My record with the most complicated client was 17 drawdown conditions. And yes, we managed and the client got the money he needed.

Timeline to pay the money

In the purchase contract, you will have a few days to pay your own funds and a bit longer to pay the funds from the mortgage. The bank is VERY strict about this deadline. For example, if you miss the deadline by just one day, the bank will most likely not send the money at all and they would usually ask for an amendment to the purchase contract to be signed, which would add extra time for the payment.

Always coordinate with your lawyer, the seller, and the bank on the deadline and drawdown conditions to make sure you can draw the mortgage in time.

Interest rate and RPSN

Before you apply for a mortgage, you most likely will have chosen a lender based on the rates they are offering. Very often the most suitable and cheapest bank can be different from your home one, so make sure you shop around or simply find an independent mortgage advisor who will do the research for you.

As a mortgage advisor, this is one of our biggest added values, since we are going to make the comparison for you so you do not have to run from one bank to another and explain your situation. I like to say speaking to a mortgage advisor is like speaking to all the banks at once.

The interest rate in the approved contract should be the same as you were promised but also watch for the RPSN rate, the Annual Percentage Rate of Costs. It is a theoretical rate that could be valid if the bank would take other costs into account for the mortgage and add them to the mortgage repayments. This could be fees for the land registry, interest payment for the first month, valuation, and more.

Visualizza questo post su Instagram

It is completely normal to see RPSN +0.1-0.2% compared to the interest rate, but if the difference is 0.3% and higher, make sure you understand why as often it means the bank added life or mortgage insurance. This life insurance can cost a few thousand per month, increasing the overall cost and RPSN so make sure you really want it.

Share the pledge contract with the seller

Part of the mortgage documentation is also a pledge contract. This is collateral/lien on the property which serves as security for the bank should you default on the mortgage. Share this in advance with the seller since they would need to sign this as well and they should also check their personal details.

Check your personal details

Since you are most likely a foreigner, your name and maybe address abroad might be more complicated than a typical Czech one. Make sure there is no mistake or typo prior to signing.

My record here is a client from Luxembourg with nine names, which didn’t even fit into the bank’s software! We needed to add the names by hand to the contracts later…

Other conditions

Usually, the bank will also require that you open a bank account with them and also send some money there monthly. Sometimes, you need to maintain a certain cash flow. For example, in Komercni Banka you should send 150% of the repayment amount to the checking account per month and make three outgoing payments.

Watch out for this condition: “Notarial deed with permission for direct enforceability”. Banks sometimes require it for riskier cases as another security. This document basically allows the bank to skip the court and go directly to foreclosure of property (execution in Czech) should you default on the mortgage. Plus you need to pay for this document yourself, which costs tens of thousands.

And a final one

ALWAYS read the contracts you are signing. Yes, the contracts are in Czech, but if you have them in a digital version, just open in Word, go to revisions > translate the whole document, CZ > EN, and violá… 21st century.

Mortgages are our daily bread. Over the last 10 years, I have seen more than 300 mortgage contracts so in case you could use any help finding the best mortgage for you, do not hesitate to ask.

Disclaimer – mortgage advisory is always free of charge for the client since we’re ultimately paid by the banks.

Did you know that you can break your mortgage fixation, sell your property, and refinance anytime, even if you fixed with the bank for three, five, or eight years or so? The bank must allow you to close the mortgage prematurely… for a cost.

And there is a big change from January. Let us start from the beginning.

What is fixation:

When you take your mortgage for let’s say 20 or 30 years, the interest rate will not stay the same for the whole time. When taking out the mortgage, you choose a “fixation period”, which means that for the next X amount of years, the rate will be fixed at for example 5.39%, which is the best rate we can get today (end of November 2023).

With this in mind, you might be tempted to go for a shorter fixation and hope the rates go down. But, if you can refinance anytime anyway, why not choose 10 years and simply break the fixation whenever it suits you?

How much did it to break fixation?

Depending on when you signed your mortgage or renewed your fixation period (which, for the sake of working out these costs, is considered a reset of your mortgage and is affected by the current rules, not the ones you signed under) these were the early repayment penalties:

- Before December 2016: The banks used to charge up to 5% of the remaining balance for each year left until the end of fixation. Back then, fixation was reaaaaally binding.

- 2016 – 2020: There was an update of the law that restricted lenders to only charge the real costs incurred with the early repayments. It was, however, not clear what the real costs were. Some banks tried to charge missed interest until the end of the fixation period which was often hundreds of thousands of crowns.

- 2020 – 2023: The Czech National Bank clarified these rules and has been enforcing them by penalizing the banks that charged clients the missed interest. As of today, to my best understanding, no bank charges an early refinancing fee higher than 1 – 2,000 CZK anymore. So yes, you can break the fixation anytime, for almost no cost.

What does the new law change?

Since clients could break their fixations and leave their banks anytime, yet the bank was still tied by the fixation, this was not completely fair for the banks and the Ministry of Finance came with proposal to specify the “real costs” as missed interest, but no more than 2% of the remaining repaid mortgage balance.

The approved law is, however, even better:

- A maximum of 1% of the repaid amount can be charged as a penalty, but no more than 0.25% for each year left until the end of fixation.

- From January to September, any mortgages signed in 2024 will be subject to the old rules but from September onwards, they will be subject to the new rules

- If you sell the property after two years of ownership, this fee would not apply

- You can still repay 25% of the original balance every year for free (one month prior to the anniversary of the loan)

Summary:

Since you can still repay anytime and the penalty will not be higher than 1%, I don’t think anyone should be afraid of longer fixations. Taking a three-year fixation these days means you might be assuming the rates will be lower in exactly three years so you avoid this penalty. But equally, you can take a 10-year fixation, wait for whenever the rate is the lowest (maybe year two, four, or never?), and then pay the penalty.

Basically, when choosing the fixation, in my opinion, there is no right and wrong answer.

If you are curious, when I took my mortgage earlier this year, I selected 5 years.

Buying a property in another country is simply not as easy as ordering food delivery through a phone app. That is a fact.

The Czech Republic might not be the simplest when it comes to bureaucracy, language, and banking so today I want to share the three biggest mistakes I see expats (but also Czechs) make when buying a property, so you do not have to go through the same again!

Oh – and one really, really bad idea to end with, something you should NEVER EVER do…

Mistake Number 1: Not using a lawyer when buying a property.

This is something I cannot get my head around and usually Czechs are worse at this than expats. The story goes like: “No, why should I need the lawyer, I think the contract looks OK. I asked my friend who works in…”

I am not speaking just of purchase contracts either, but even the first reservation contract, which you sign when you want to take the property off the market.

Recently I heard a story “I need a lawyer, I signed a contract and now there is a problem since the seller is doing XYZ”. Better late than never, however, if the contract is already signed, there is very little you can do.

Long story short, use a lawyer and let them revise the contract before you sign anything!

Mistake Number 2: Trusting the agent on the property size (m2) without verification and valuation.

The flat is 60m2 is what you see on sreality.cz or similar websites. But somehow, it feels smaller. And then you realize that it is actually including 5m2 of cellar. And it was 59.1 m2, it just looked better on sreality.cz as it was rounded up to 60.

This information you should request to see in an official document from the seller, such as a utility bill from the SVJ (Home owner’s association of the building), original purchase contract, or founding document of the building itself.

A similar option would be to have the bank valuation done if you buy using the mortgage before you sign a reservation contract.

For purchases for my clients in Prague, most often we do online valuation which takes only one to two days. If in person, then it’s about one week. The agent might be pushing for the reservation but I simply call them and explain we’re not comfortable signing upfront because there’s a risk we will get a lower valuation later. Since it’s only a matter of a few days, give us the necessary documents, we’ll check with the bank, and then we can move forward.

Works like a charm!

Mistake Number 3: Trusting your own bank is the best for a mortgage.

I have heard too many times that people think they cannot get 90% financing without permanent residency or because they are older than 36. Other common things include that people think banks don’t accept income from overseas or that they cannot get 90% financing if they are not EU citizens.

Over the last 10 years of working with expats, I heard most of these stories and my comment is very simple: did you check with all the banks?

Of course not. Who would want to spend their time finding English-speaking mortgage bankers and explaining their situation over and over again? This is the job of mortgage advisors which is why I like to say that speaking to a mortgage advisor is like speaking to all the banks at once.

My last comment on this mistake: Loyalty in terms of banking is hardly appreciated. If you are with the bank for 10 years, do not expect any better conditions than anyone else would get. Very often we just go to different banks since they are cheaper than our home bank.

And the last thing… the thing to NEVER EVER do:

Never send the money directly to the seller’s account when you buy a property (unless it’s a developer).

If you are using a lawyer, then they would not allow that for sure. For this reason, there is an escrow account in place, which makes sure the seller gets the money only when you are the rightful owner.