Are you tired of the Prague city lifestyle and ready for a change? Or perhaps you did your math and figured out that it will be much more efficient to live outside and commute to Prague, instead of paying the high property prices in the capital.

Well, pack your bags and get ready to explore 15 decently sized cities (population of 10,000 or more), where it might be easier to achieve your property dream, yet still within a short commute to Prague’s city center. Pros and cons are included, as well as some personal tips.

First of all – why consider living outside of Prague? Well, there are many reasons:

1. Money, Money, Money: Who doesn’t love saving a little extra cash? By living in a smaller city, you can enjoy a lower cost of living, including more affordable housing, food, and daily expenses. Just check sreality.cz for the cost of properties in the nearby cities and you might be pleasantly surprised so see what is possible there for purchase!

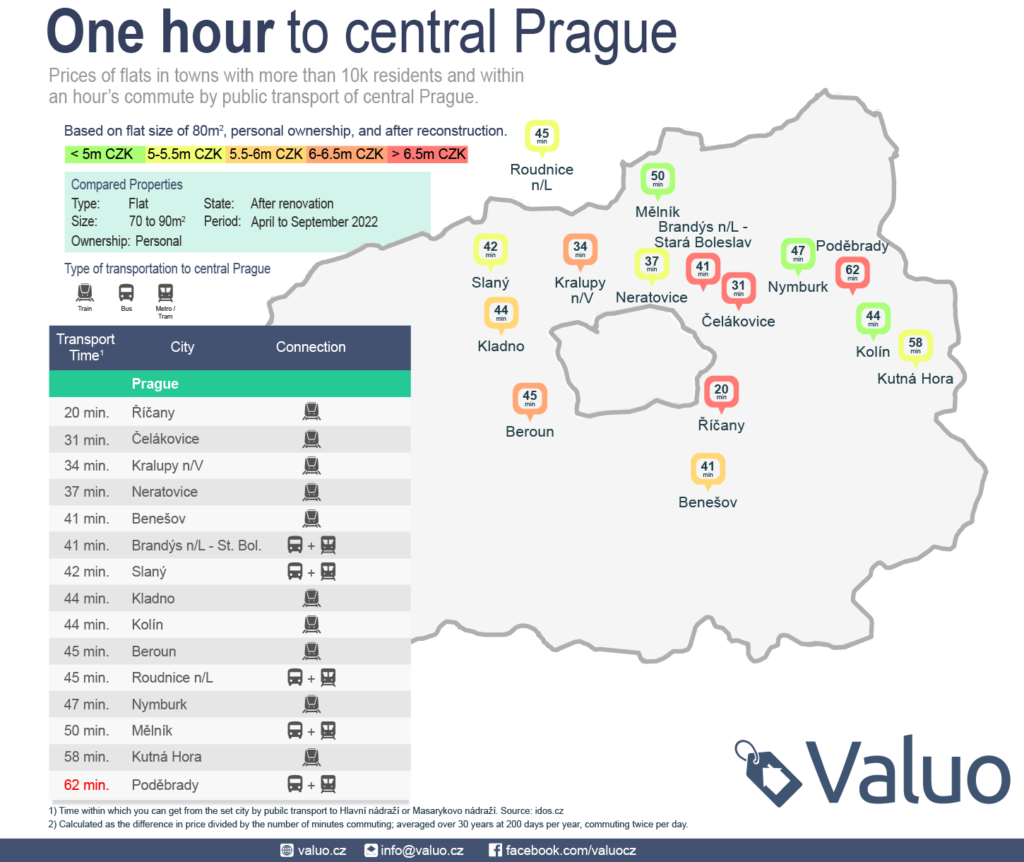

2. Shorter Commute: This handy infographic produced by Valuo.cz shows 15 cities from which you can get to the center of Prague in less than one hour by public transport. If you compare this to some areas on the outskirts in Prague, Bohnice for example, you’ll find your commute from the smaller cities quicker! Oh, and the time on the train or bus – you can use for reading your favorite book, enjoying the view or work, of course…

3. Community Connection: Smaller cities offer a close-knit community feel, where you’ll find friendly locals and plenty of opportunities to get involved in local events and activities. My personal tip? Join a sports team or volunteer at a local organization to meet new people and feel like a true local and improve your Czech! Yes, at first this might be strange and new to you but I am sure you will adapt very quickly!

4. Natural Beauty: Many of the smaller cities in the Czech Republic are surrounded by beautiful countryside and nature. This can provide a welcome escape from the hustle and bustle of city life and offer opportunities for outdoor activities with your family or just to enjoy yourself outside.

Cons of Living in Small Cities

- Job Hunting: While living in a smaller city may be more affordable, it may also limit job opportunities, particularly if you’re working in Prague. Make sure your work is aligned with the commuting (also taking into consideration transport delays) and that you won’t need to be in Prague at 7 am often, for example, as this could be rather challenging sometimes!

- Lonely Expat Story: In smaller cities, the expat community may be smaller and less diverse. My tip? Join an expat group on social media or attend a language exchange to connect with other like-minded individuals in the city. Use the power of social media and start a local group of expats if there is none!

- Entertainment: Compared to Prague, smaller cities may have fewer entertainment options, such as theaters, museums, and restaurants. Take advantage of the local parks and outdoor activities, and plan weekend trips to Prague for a cultural fix.

In conclusion, living in a smaller city in the Czech Republic offers a unique and exciting opportunity for expats to experience a new culture and lifestyle. With the help of our infographic and personal tips, you can weigh the pros and cons and make an informed decision on where to call home.

Whether you’re commuting to Prague for work or settling down in a charming small city, the possibilities are endless. So, grab your Czech railway pass and start exploring!

PRO tip: If you would commute via train, consider IN karta, which will give you further discounts on train tickets. Myself, I travel to Ostrava about once a month and the average price for me with IN karta 50 is about 300 CZK, which is cheaper than renting a co-working place in Prague! So if I need some peace and quiet, the train is favorite choice of mine!

If you are considering buying property in one of these smaller cities, Expats Finance can still help. In fact, we can help no matter where in the country you are planning to purchase.

The real estate market in the Czech Republic has seen a significant shift in the past year, with an increase in the number of properties available, and a downturn in both the number of properties sold and the volume of mortgages being taken out.

This change has been driven by a number of factors, including economic uncertainty and changes in consumer preferences. In this article, we will take a closer look at the key takeaways from the real estate market in 2022 compared to 2021.

Now, I’m a naturally curious person and as such, I’m constantly monitoring the market but even I was surprised to see the number of available property adverts on sreality.cz increased 100% year-on-year for both rental and purchase properties. You might be thinking this means there’s a lack of potential buyers out there, but it’s more to do with properties are sitting on the market longer. What I’m seeing though is not necessarily an aversion to buying, but rather people being cautious and keeping an eye on the market, waiting for the good deals.

For example, January is normally the quietest month of the year in terms of the property market, but I’ve had a record number of inquiries from potential buyers, which suggests that despite the downturn in the market, there is still a high level of interest in real estate in the Czech Republic.

The total amount of properties sold decreased by 26% in December 2022 compared to December 2021, both for flats and houses. This trend is also reflected in the number of flats available for sale for longer than 120 days, which is 36%.

One of the most significant changes in the market has been a drop in the volume of mortgages being taken out. In 2022, the mortgage market suffered a 64% drop compared to 2021. The reasons for this, in my opinion, include the war in Ukraine, high energy costs, general economic uncertainty, and relatively expensive housing compared to the average salary.

Another trend that has emerged in the real estate market is a decrease in the average sale price of flats. In December last year, the average sale price was 6.2% below the asking price. This trend is also reflected in a difference in asking prices between Q2 and Q4 last year: 6.9% lower for panel flats, 4.9% for brick, and 2.5% for new developments in Prague. To put that in perspective, if a panel flat was being advertised 6.9% cheaper than it was previously advertised for, combined with the 6.2% average difference in asking price to sale price, a lucky buyer could have scored themselves a 13.1% discount!

But while property sales were suffering, owners offering their properties for rent experienced the reverse, with an average 8.3% increase in rental prices in Q4 compared to Q1. This was largely down to supply and demand, with demand increasing due to the influx of people fleeing the war in Ukraine and people deciding to rent rather than buy right now.

Of course, there are other reasons affecting the market downturn too. To summarise them all:

- 20-year high mortgage rates

- High property prices push some people out of buying

- Regulation over lending capacities introduced by the Czech National Bank

- The war in Ukraine

- General economic uncertainty

- Rising energy costs

All that being said, we are seeing some light at the end of the tunnel. After 10 years in this business, I’m happy to finally be seeing a proper shift towards it being a buyer’s market. Especially in recent years, it’s been hard for buyers with high competition for properties leading to bidding wars in some cases.

I even had one case where a seller decided not to sell to a mortgage-backed buyer because it would have been too much work for them! (Pro tip: It really isn’t!)

Today, it’s the opposite. As a buyer, you can negotiate the price, there is lower competition for properties, and in some areas there are general price drops.

Happy property hunting!

And if you want help with the whole process, you know where to find me.

The cooling of the real estate market is already visible and developers are suffering from the lowest number of inquiries in a decade.

In a market like this, it is not uncommon that developers simply stop construction in order to save money, rather than building apartments and having them left empty, waiting for buyers.

This is exactly the case of Central Group, one of the biggest development companies in the country, which is delaying building of 730 units by about a year.

“We are reacting to the situation on the market. At a time when sales are slowing down by more than half, it is not efficient to build new apartments for storage. There is a bad mood and uncertainty, people are interested in apartments and are asking, but they are postponing purchases. Instead of sinking billions into the development, it is better to have them free for acquisitions,” explained by Dušan Kunovský, the owner and founder of the largest residential builder in the Czech Republic.

They expect sales will go up again in about a year or in 2024, with the biggest deciding factor being the mortgage interest rates.

“The turning point, which according to analysis, should bring a renewed boom in the sale of apartments, is the reduction of mortgage interest rates to the level of three percent per year. This is already the limit when the monthly mortgage payment approaches the amount of the monthly rent,” said Kunovský.

To put that in perspective, a mortgage of the same amount with today’s interest rate of 6% vs 3%, means a difference in monthly repayments of roughly 30%.

This saving is what they believe will kick off the purchasing of their units again.

What is the worst that can happen when you purchase a property? You receive it in a worse state than you viewed it? Or the tenants don’t want to leave? Perhaps it’s incredibly loud neighbors?

This is nothing compared to what (could have) happened to one of our clients earlier this year… Buckle your seatbelts, we are going to take you down the rabbit hole. But don’t worry too much, this one has a happy ending!

This is the story of a young expat family expecting a baby. They were in a bit of a rush to purchase a property before the baby arrived, but still had plenty of time to search for the right apartment. After watching the market for a couple of months and viewing dozens of places, they finally found their dream property. The seller was a reputable company with a long track record and all went well… The viewing, the bank valuation, reservation, signing, and paying money.

It all went well until the last part. You might already know that when you purchase a property the money usually goes to an escrow account – a third-party account that holds the money safe until you are the owner then releases it to the seller. It is a common practice to use lawyers and the lawyer which was used in this case was reputable, with years of experience and no indication that anything was wrong.

The money was transferred on its way to the escrow when we got a last-minute call from the seller: “Stop the transaction immediately.”

“Why? We have the money ready and we have five days to pay the purchase price”

“There are police at the lawyer’s. She is being accused of fraud, the money might not be safe with her.”

“What!? Really? Are you telling me the lawyer is misusing the escrow money?”

I have to say, in ten years of doing this job, that was the strangest phone call I’ve had with a seller.

In fact, I remember the last such case to make news headlines – back in 2012 a lawyer misused 65 mil CZK and was sentenced to eight years in prison.

Now let me skip the hours on the phone with the seller, the bank, and our lawyer and jump straight to the end. The funds our client paid from their savings were “lost” in the lawyer’s escrow account but we saved most of the money as it remained in our bank. We signed an amendment of the purchase contract, redirecting the rest of the cash flow and the seller acknowledged that he will be sorting out the missing money on his own.

With the new setup, the bank continued and sent the money to the new escrow account and the transaction was completed.

You might be thinking – why did the seller do that? Why would they accept the loss of the money? Well, if they would have not done it (or if we would have sent the bank money already), the transaction would have been frozen, we would have to file a court appeal and it would drag out for years. Our client would not have the money as the bank would already have sent it to the fraudulent accounts, the transaction would not have been completed as the lawyer was taken into custody, and we could have been stuck in that middle ground for years until the dispute was resolved.

But thankfully the deal was saved. The client got the flat with only about a month delay and the seller got the rest of the purchase price, the majority of it, so his loss was minimized as much as we could.

What is the conclusion? Could this have been prevented? I was personally meeting the lawyer with the client and the seller and I can tell you, there was zero indication anything was wrong. Two weeks later, the police arrested the lawyer in her flat with her luggage packed and ready to leave the country. As of today, there are 19 damaged parties and missing 120 million CZK from the escrow accounts.

My advice? Always, always and always have a lawyer on your side. Do not rely on the lawyer of the seller/agency. If we would not have involved our one, if we would not have structured the contracts as we did, it would have been way worse! I wish I could say it could have been prevented, but I do not know how… These things are extremely rare and impossible to predict.

With all this being said, please do not get me wrong and start mistrusting the escrow process. The escrow is pretty much a standard of the industry, with about 95% of transactions of second-hand properties going through escrow accounts.

In the end, allow me to thank our lawyer, the client, seller, and the bank for cooperation. This was by far the most difficult transaction I have had in my career and we were very lucky we reacted the way we did.

Safe purchasing to everyone!

Did you know the most expensive villa in Prague is on sale for a mere €14m (340m CZK)? To put that in some perspective, the unique Jindřišská Věž is up for sale with starting price of 75m CZK.

Both definitely not the cheapest properties around but today we bring you a list of the most expensive and also the cheapest areas in Prague where you can either spend a fortune or grab a bargain.

As you probably know, the real estate market, after 10 years – hit the wall. High-interest rates, expensive properties, skyrocketing energy costs, and the war in Ukraine, all of that combined caused the property market to freeze and change direction, meaning bargains could become more commonplace.

We asked two real estate experts which areas of Prague are the cheapest and most expensive to purchase a property in general, then we asked two property valuers their perspective?

Which areas in Prague have the lowest price per m2?

There is no surprise that the further you get from the center, the less expensive properties are, so naturally, we are looking at the suburbs at the edge of Prague. There is a Czech term “sídliště”, which refers to an area of panel buildings, typically built between the 1960s and 1980s in the soviet era with the intention of maximizing living spaces for people moving to the city from all around the Czech Republic.

According to Nick Marley, a professional real estate investor, “the cheapest properties in the city can be found in areas like Čakovice to the North and the Štěrboholy to Uhříněves area in the East. Neither of these are well served by public transport and don’t have great local amenities.”

Flats with a price tags under 100,000 CZK / m2 is a no problem there.

“For cheaper properties close to the centre of the city, look in Žižkov around Husitska street. It’s cheaper because it is somewhat cut-off (despite being so close), having only a bus service and amenities which are not the best,” he adds.

Pavel Korima, an independent property valuer suggests the area of Horní Počernice for the cheapest price. On one hand, it is pretty far away, but on a bit brighter note, it is quite close to nature and could be good for people who need to travel outside of the city as it is are close to highways.

The key element for property prices is both the area, but also the uniqueness of the building, says Jaroslav Hrabák, the second property valuer we asked. You can live in nice area but if the building is just next to a busy road, the price should be adjusted accordingly.

These days, the energy cost and also commuting time to the city is the main driving factor of the price, besides of course, the state of the property.

There are also two specific areas in terms of a minority of the citizens living there and that is the area of Stodůlky, where lives a big community of Russian-speaking citizens and of course around SAPA in Prague 4, for Vietnamese.

We also asked Pavla Temrová, a personal real estate agent who says about the cheapest prices:

“Within Prague, these are large panel housing estates (sídliště) with a lack of parking spaces and a bit higher crime rate. But even within large housing estates there are big differences and cannot be generalised. For example, the southern city, Chodov, is closely followed by Prague 9 localities such as Černý Most, Rajská zahrada, and on the opposite side of Prague is the Hůrka, Luka metro area.”

Now speaking of luxurious properties, which are the most expensive areas?

Pavla starts by sharing her experience: “The most beautiful, most desirable and most expensive residential locations in Prague historically include Prague 6, specifically Dejvice, Ořechovka, Střešovice, the so-called embassy locations around Stromovka Park. Then Břevnov (Prague 6), Malá Strana, around Prague Castle, then Podolí (Prague 4), around Vyšehrad (Prague 2). Vinohrady (Prague 2), around Letenské park, and Troja are also regulars. In addition to exceptional architecture, all these locations boast a strong historical tradition and patriotism.”

Pavel Korima, our first valuer suggests that streets like Ovenecká and area around Veletržní palác is indeed very sought after due to beautiful architecture, wide streets with alleys and Stromovka park. Same for Polská street in Vinohrady, the close proximity to parks makes a real difference.

You can then of course add the classic areas, leading with Pařížská street, river banks on the right side (Rašínovo nábřeží) and especially the Malá strana starting from Most Legií up towards the Malostranské náměstí and the super prime locations of flats on Kampa. A price tag above 200.000 CZK per m2 is nothing out of the ordinary there. Pretty much all of those buildings are under heritage protection and have a rich mostly merchant history.

Nick adds: “If you are looking at exclusive areas (outside of the tourist zones), mainly for villas, try Střešovice or Černý Vrch. Střešovice contains a number of embassies and is also where the president’s house is. Černý Vrch is more popular with celebrities and offers stunning views of the city.”

Speaking of premium places, it is not only the location but the view which forms a big part of the price. The most sought-after is view over the river, Charles bridge and Prague Castle, which is no surprise.

Both valuers also agree that the biggest price tags are for villas in Prague 6 as mentioned earlier and also do not forget the stunning area of villas in the border of Vinohrady and Vršovice. Those are built during the “first republic”, in the beginning of the 20th century and very often by famous architects.

To end with, Pavla also shared two useful links for anyone interested in buying a property:

- www.znecistovatele.cz a practical application that reveals sources of pollution in a selected location. Within a few seconds, you will find out if the area where the property under consideration is located is not polluted by toxins.

- www.mapakriminality.cz – to check the criminality in the local area.

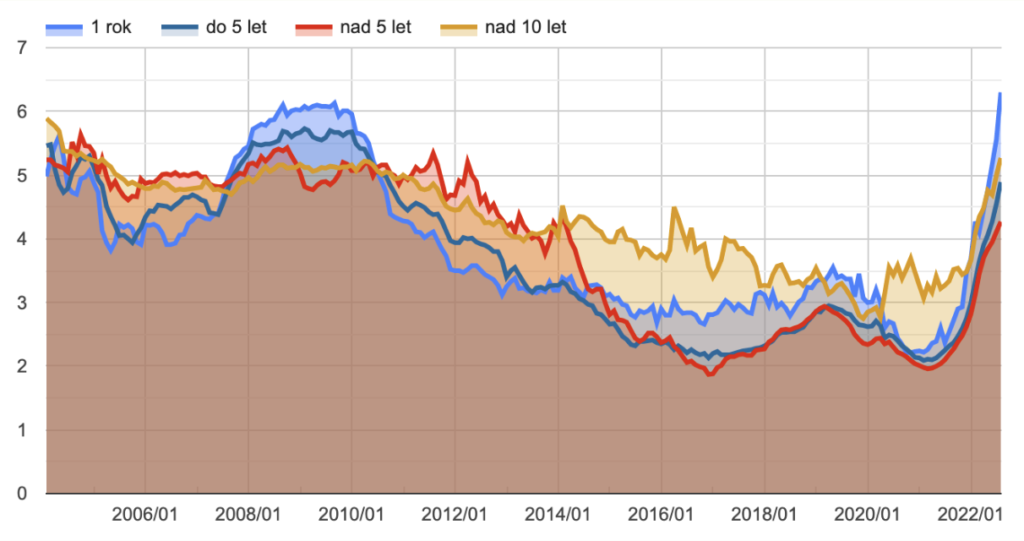

The mortgage market is down more than 80% (in volume) compared to last year and clients are experiencing the highest rates in the last 20 years.

If someone was waiting for recession, I believe now it is now safe to assume, winter is coming. At least in the real estate and mortgage world.

- 4/5 of people buying properties using mortgages are out, temporarily

- ČNB keeps the 2W repo rate at 7% – no change for a few months

- Mortgage rates are “stabilized” for now at around 6%

Anyone who has been looking to buy a property in the last few years can surely confirm, this year and the past six months, in particular, have seen a lot of changes.

While last year, as a buyer, it was quite often the case that the property was sold before you got to even see it, right now, properties are sitting on the market much longer. Last year it was common to have bid on the purchase price, right now asking 10% discount is nothing strange.

What does this have to do with the interest rates?

Well, the rate is one of the main reasons why the real estate market is experiencing a freeze like Napoleon in Russia. No? Two puns in one article is too much? Alright…

The good news is, it seems like the rates are not going much further. At least right now. For about four months the best mortgage rates have been in the same range: between 5.5% and 6%. At a recent board meeting, the Czech National Bank also decided to keep the 2-week repo rate unchanged at 7%, which is one of the main drives for a possible change in the mortgage rates.

In the Czech market, there are two main statistical sources for watching the rates:

- Hypoindex.cz follows the offering rates, reports usually in the first or second week of the new month

- CBAonline.cz has the data directly from the banks but it takes them a bit longer to process – data available in the middle of the next month

The feedback from most experts in the industry is that we should not be expecting any significant drop in the following year, maybe even until the end of 2023.

The volume of new mortgages in October was just above 6 billion CZK, same as in September.

Finally, it seems like inquiries have stabilized for the second month in a row, let’s see how the next two months will perform. Usually, the end of the year is nothing exciting in terms of new mortgages being signed, but some banks, in order to fulfill their quotas, might surprise with some last-minute interest rate discounts.

In what could be the biggest transaction in Czech banking since its privatization, Česká spořitelna looks set to take over the Sberbank debts.

The news, announced by Sberbank insolvency administrator Jiřina Lužová recently, signals an end to uncertainty for thousands of mortgage holders throughout the Czech Republic.

Former Sberbank clients have been waiting for over eight months for the information regarding which bank will take over their mortgages and loans and while it was possible to keep repaying loans, other banking operations within Sberbank were massively limited.

This caused morale amongst its clients to drop and therefore encouraged the insolvency administrator to aim for a relatively fast sale. However, the transaction still has to be approved by the regulators, the Czech National Bank and The Office for the Protection of Competition.

From the banks that were originally interested, the most advantageous offer was submitted by Česká spořitelna. According to Sberbankcz.cz the bank will pay 41,05 billion CZK for the total nominal value of assets of 47,1 billion CZK.

One could say that Česká spořitelna got a bargain with a discount of 12,7%! With these numbers, we are speaking of the biggest transaction in the banking sector in the Czech Republic ever.

“The signing of the contract on the future contract with Česká spořitelna is great news for all loan clients and creditors of Sberbank CZ. The insolvency of Sberbank CZ is one of the largest in the history of the Czech Republic, both in terms of financial volume and the number of creditors, which is why I am very happy that we managed to achieve this extraordinary result in a very short time,” commented administrator Jiřina Lužová.

How many clients are we speaking about? There are 43 thousand loans distributed amongst:

- 659 companies

- 3184 entrepreneurs

- 31 588 retail clients

There is also total of 13.322 mortgages and 20.277 personal loans, which would be transferred to the new bank.

Although we are aware of the new bank’s name, customers will likely have to wait until the first half of 2023 for the deal to be finalised. Česká Spořitelna requests that former Sberbank customers not get in touch with them until there are further instructions from the banks, as the specifics and next measures have not yet been finalized.

So what do you do if you have a loan with Sberbank?

At the moment, nothing. Just keep repaying it and make sure the bank has your up-to-date contact details and await further instructions.

Word with a mortgage advisor:

“Back in February, we had a mortgage approved with what seemed to be the best conditions on the market with Sberbank. Until the last minute, everything went relatively well, but on the day of signing, 24.2.2022, the banker called me and said not to come for the meeting. The bank is going to be closed, he said, and there is no point in signing this contract, as the bank will not be able the fulfill it. The next day, the bank closed officially.

I am glad we didn’t sign it in the end. If we would, the bank would not send the money anyway to pay the purchase price. So we looked for an another bank and the purchase was of course finalised using some other bank.

Another, unfortunately, sadder story was with clients who already had a mortgage signed for a development project under construction, but the bank didn’t release the money by the time of default. The signed rate was 1,89% fixed for 10 years.

When we found out that the bank was not going to be able to fulfill their contracts, the clients realised they are not able to get a rate anywhere close to that 1.89% in March 2022. Their choices were to either find a new bank with higher rates, or pull out of the purchase.

They decided for the latter option, all contracts were cancelled, and the loss was minimized. Luckily (or by bad luck), clients planned to leave the Czech Republic anyway, later this year.”

Hello everyone, my name is Robin and I am glad to be your real estate guide for Prague. If you want to know more about Prague, its districts, its history, and the best options to buy, keep an eye on my column to get the inside scoop!

Over the last 10 years, I have helped over 300 expat families purchase property in this beautiful country and now I’m here to talk about everything I’ve learned in the hope it can help more of you.

Because let’s be honest, if we think about Prague specifically, it really is a city like no other, right?

According to our research, Prague scores pretty highly amongst expats for its standard of living, great public transport, work opportunities, safety, and of course the beautiful architecture. It’s no wonder so many expats are looking to buy property here.

This article is an introduction to the new series about everything to do with Prague real estate and related material that will interest you even if you are not looking to buy.

For example, did you know panelaks (those tall, plain apartment blocks) are a legacy of communism and its drive for simplicity? Another fun fact about panelaks: while this style of building might be seen as something for lower-income families and in some cases come with a certain social stigma in other countries, that’s not necessarily the case here in the Czech Republic.

What else can you look forward to?

- More fun facts about paneláks and why they could be a good investment

- How to select the right renovation company

- Secrets of Vinohrady villas

- What happened to all the property developers in the current market?

- What’s happening with real estate prices and when can we expect them to drop?

- Quarterly market reviews

- Monthly webinars for first-time buyers

- Inside scoops on developments in various areas of the city

All in, I intend for this column to become a complete guide for expats on buying properties here in the Czech Republic, with a healthy dose of entertainment and fun facts for the rest of you readers.

For those of you who might have met me before, or know me from the Facebook Group Czech Expats Property Owners, you will know honesty and precision is my main drive.

Therefore, in the next upcoming months, you will see on Prague Morning:

- new series of articles and statistics about properties in Prague

- inside facts from a Czech person who is in the Expat community

I love this country and I love helping expats settle down here by buying property. If you have similar interests, stay tuned for this column!

In the meantime, if you have any feedback, any questions about buying properties, or suggestions of topics you would like me to cover, please don’t hesitate contact me.