Rates Are Falling - What it Means for the Property Market

Robin Petrasek

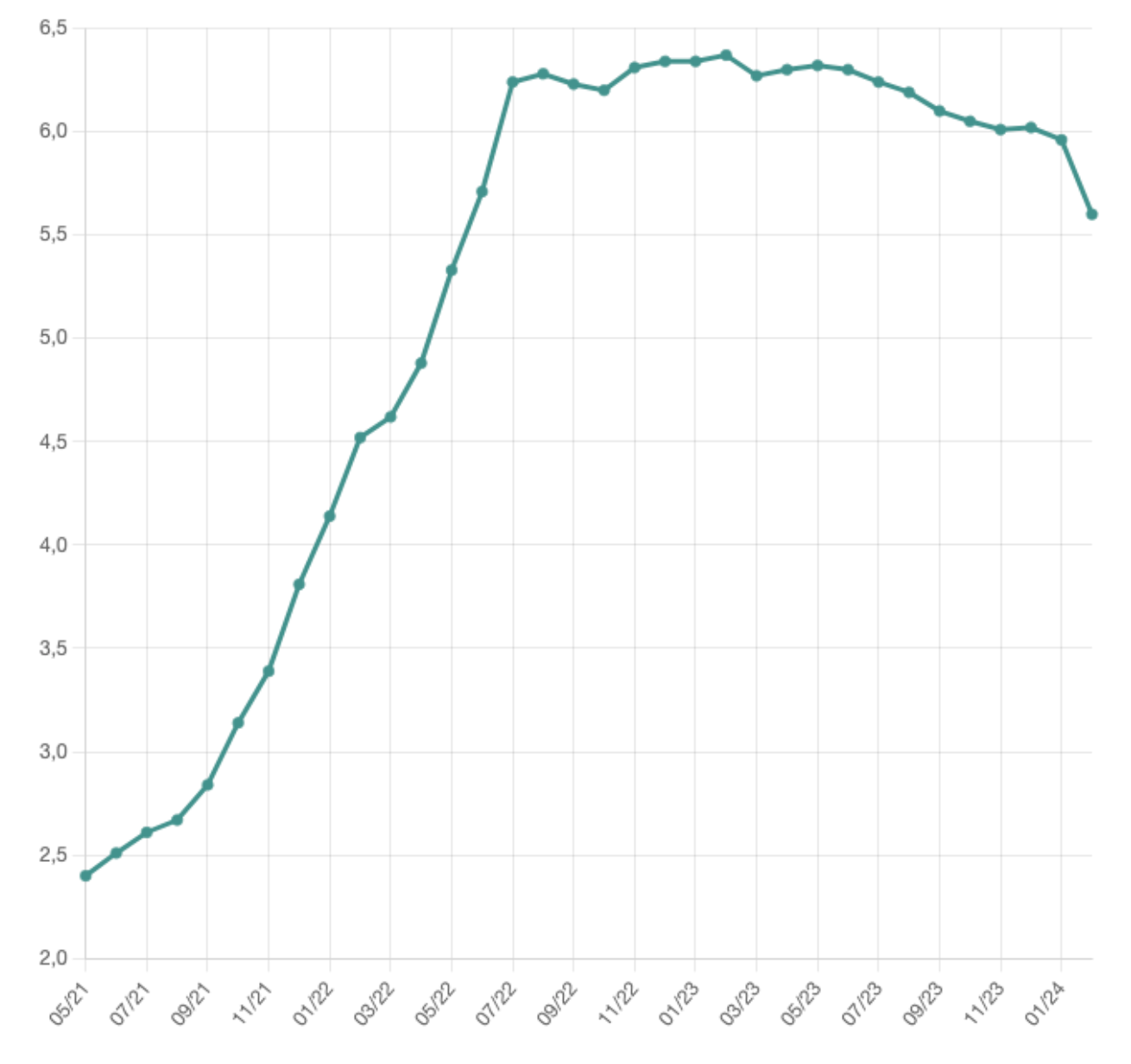

On Thursday last week (February 8th), the Czech National Bank lowered the inter banking rates by 0.5%, to what is now the lowest rates since June 2022.

It was about time… In December, they lowered it 0.25% and now, with the lowering of 0.5% to the current rate of 6.25%, I think it sets a clear trend of lowering rates that I believe will continue until the end of the year.

What does it mean in real life?

Long story short, cheaper loans and less interest on savings accounts.

With lowering the rates, the Czech National Bank wants to stimulate the flow of money into the economy, rather than encouraging people to let money sit in a bank account or avoid borrowing due to high interest rates. Lowering rates should mean the opposite to stimulate the economy

Did the interest rates already drop?

No, not yet but we can expect it very soon to happen. Right now (as of 13.2.2024) you can still find savings accounts which provide more than 6% on savings but I suspect it will not last for very long.

Similarly, mortgage banks haven’t reacted to this recent lowering yet. It typically takes a few days or weeks for the banks to update their offers but again, I think we can expect lower rates soon.

However, don’t expect an immediate 0.5% drop since the cost of mortgages is dependent on more factors than just this 2W Repo rate from CNB.

We have already seen in February that mortgage rates did indeed go down to an average of 5.6%.

source: hypoindex.cz

What will happen to the property market?

In theory, the equation is simple, when rates go down, it is easier to borrow money and if the economic situation in the country is good and people feel secure, the demand for properties increases. If there is enough supply of affordable properties, it is not a problem.

If there is generally a shortage of flats, and we can argue that this is the case in Prague, I think you can imagine what might happen again to the property prices. Mortgages at 5% are still relatively expensive (compared to the last 10 years in the Czech market), but it is clear from the increased amount of inquiries that 2024 will definitely be a stronger year than 2023 in terms of property sales.

And maybe, we will see another year of appreciation of properties.

Unless something unpredictable happens again…

-

NEWSLETTER

Subscribe for our daily news