Czech Bank Challenges Revolut With New Multi-Currency Service

Prague Morning

A Czech financial institution is stepping deeper into the foreign-exchange market, introducing a multi-currency account designed to compete with fintech platforms such as Revolut.

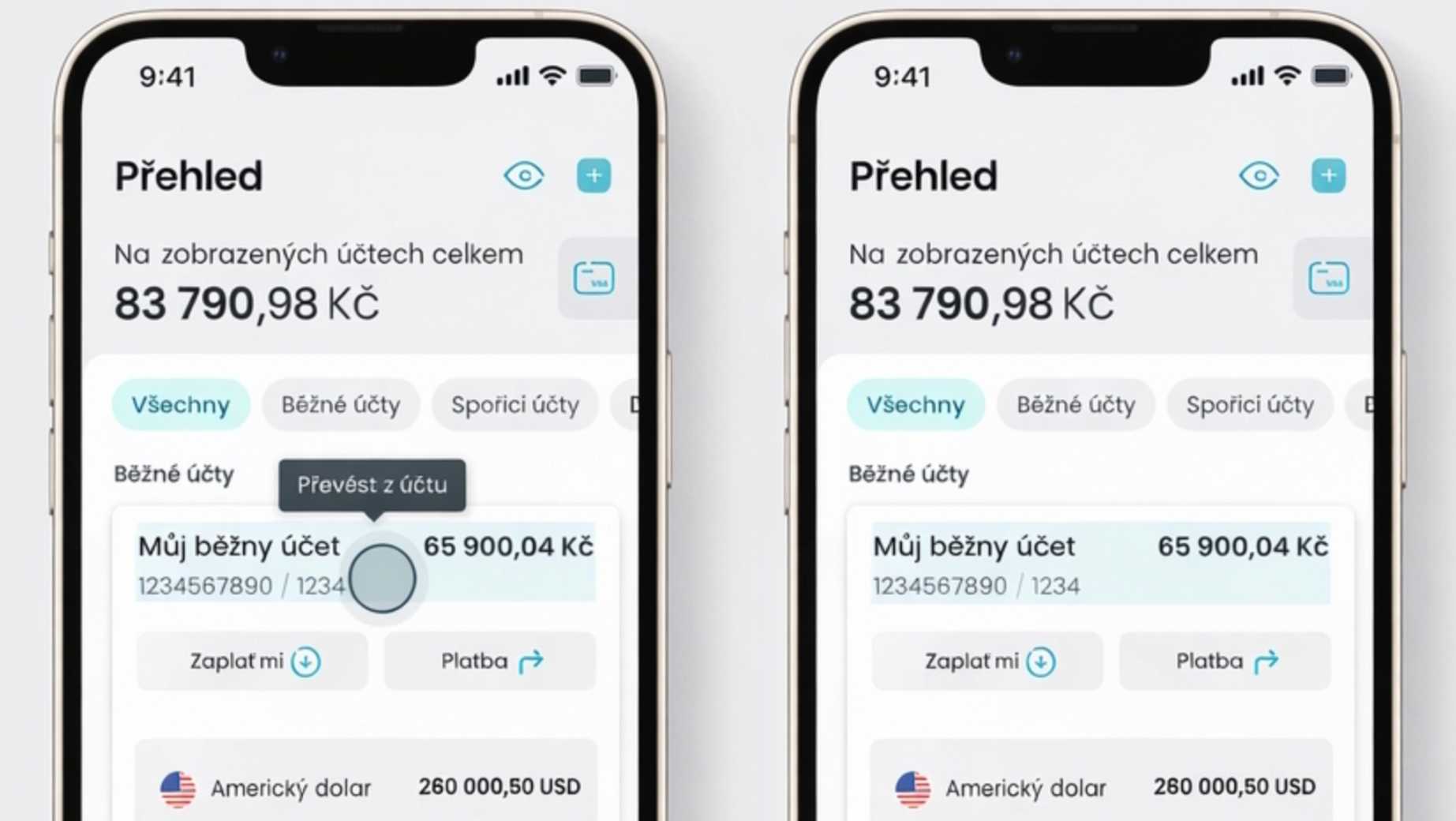

Partners Banka now allows clients to hold and manage several currencies within a single account without extra fees. The bank says the goal is to simplify everyday international payments while keeping exchange costs predictable.

Unlike some digital competitors, the service is integrated into a standard current account. Clients can activate or remove currencies as needed.

Transactions show the exchange rate before confirmation, and conversions are processed immediately. The account currently supports 15 currencies, including the euro, U.S. dollar, and British pound.

For card payments abroad, the bank applies the European Central Bank reference rate without markup for 31 currencies. That includes major currencies as well as regional ones such as the Polish zloty.

How the Exchange Model Differs From Revolut

The Czech bank relies on a fixed ECB reference rate updated daily and applied continuously. Revolut, by contrast, uses a live interbank rate that changes constantly. While Revolut usually offers that rate without markup during weekdays, extra charges may apply over weekends.

Limits also differ. Partners Banka says it does not cap foreign-currency card payments at merchants. Revolut’s free Standard plan typically applies a monthly ceiling on favorable exchange conditions, after which additional fees can apply.

Manual currency exchange in the Czech bank’s mobile app carries a commission between 0.45 and 0.7 percent above the ECB rate, depending on the currency. Revolut allows a set monthly volume of exchanges without fees on its basic plan before introducing surcharges.

Cash withdrawals present another contrast. Partners Banka offers unlimited ATM withdrawals worldwide without extra charges, while Revolut’s entry plan generally restricts free withdrawals by amount or number.

Technical Operation of the Account

All currencies remain under one account number and IBAN. When paying in Czech crowns, funds are taken from the main crown balance using the ECB conversion rate. When paying in another currency, the system first uses the relevant currency balance. If none is available, funds are converted automatically from crowns.

For transfers, the Czech IBAN is used within the SEPA payment area, while a British IBAN handles other incoming international payments.

Growth Plans and Market Position

The bank serves more than 160,000 clients. Management says the aim is not direct confrontation with fintech firms but becoming the main daily bank for customers who currently use digital platforms only as secondary accounts.

Further steps are already planned. A multi-currency savings product is under preparation, along with the option to set a primary account in a currency other than the Czech crown. The bank also expects to introduce Bitcoin purchase services this year.

Would you like us to write about your business? Find out more

-

NEWSLETTER

Subscribe for our daily news