ČNB Lowers Rates Again: Cheaper Mortgages and Less Interest on Savings Accounts

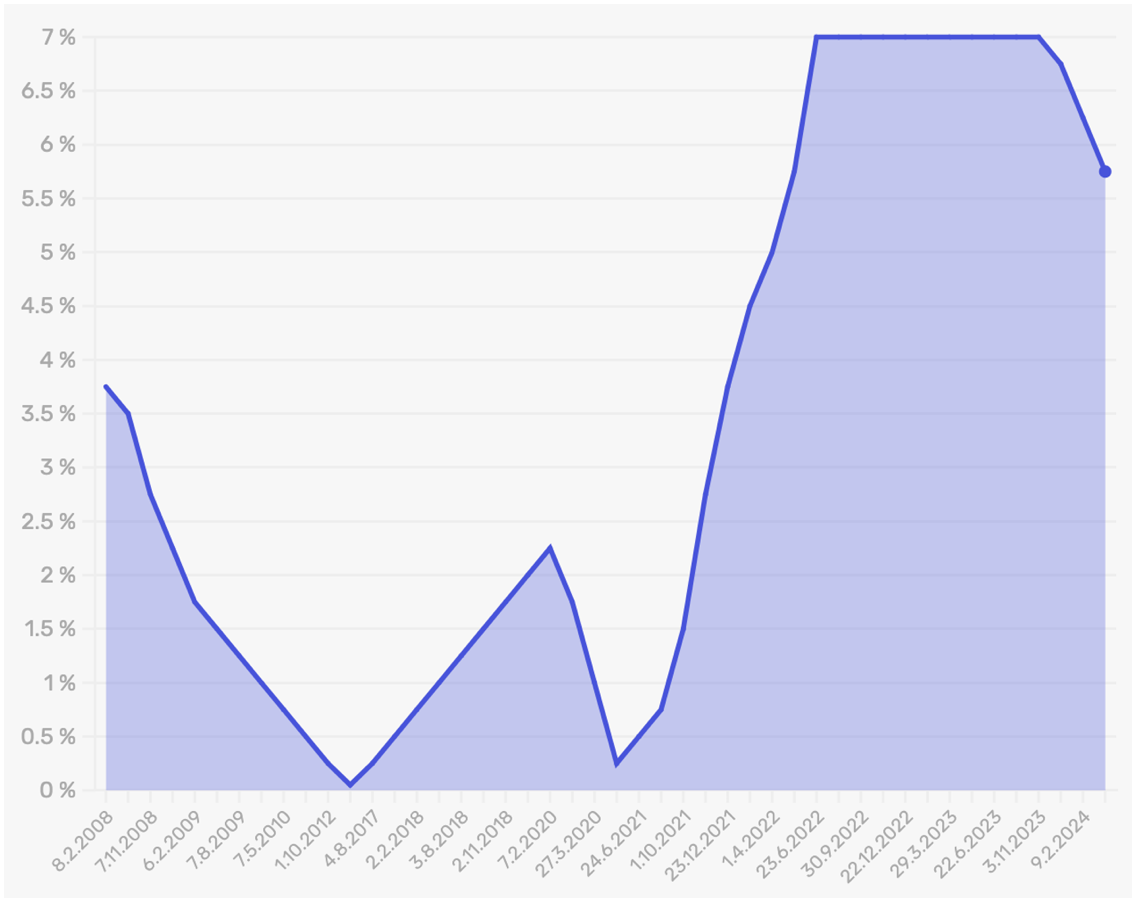

The Monetary Board of the Czech National Bank (CNB) has reduced the key interest rate by half a percentage point to 5.75 percent, reaching a level last seen in mid-June 2022.

Both the market and analysts were expecting a half percentage point decrease, so the Monetary Board’s decision should not have a significant impact on the exchange rate of the crown, stated Jakub Seidler, Chief Economist of the Czech Banking Association.

According to Seidler, a decline in interest rates can now be expected for both corporate loans and deposits, as well as mortgages.

“The central bank’s decision only confirms the established trend and market expectations, which have already been reflected in longer-term market rates. These rates began to decline at the end of last year due to expectations of faster rate cuts by central banks.”

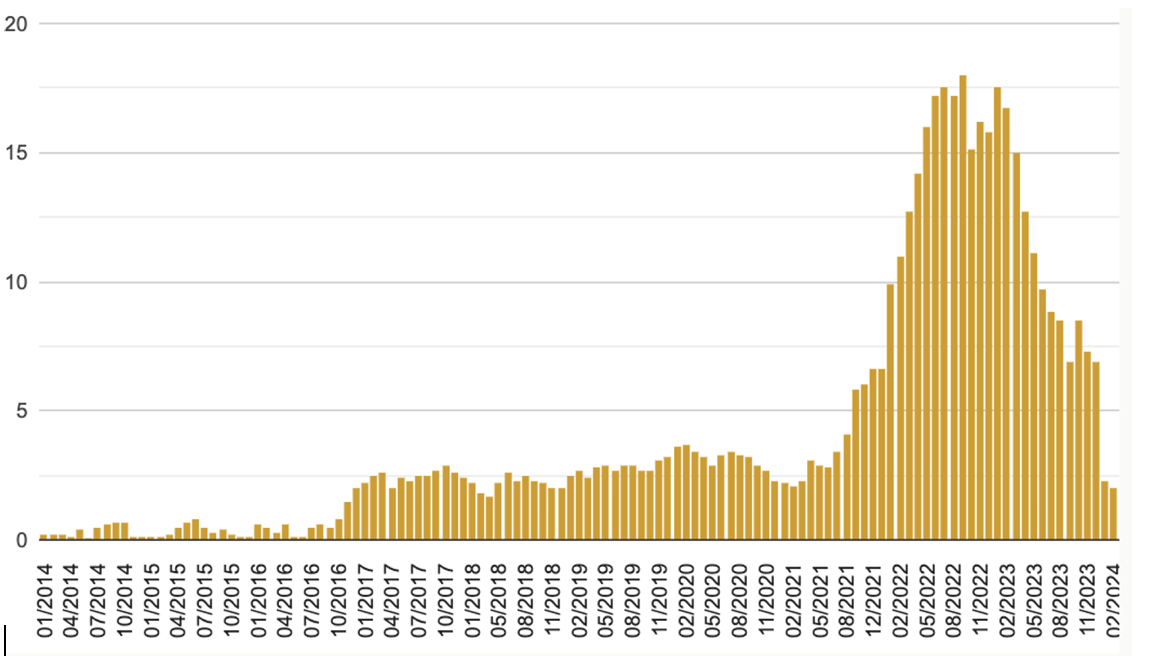

From my point of view as a mortgage advisor, given rates have finally dropped under 5%, I think later this year the trend will surely continue. This will help revive the real estate market which, over the last two years, has experienced the lowest interest in a long time.

What is a bit surprising is the amount of interest in purchasing properties we are experiencing at the moment. If we compare it to four months ago, the drop is not yet that significant (no more than 0.5%), but we are having more than double the amount of inquiries which signals more and more people entering the market for purchases.

While the financial difference in repayments is not that significant for a 0.5% decrease, the reason is mainly psychological in my opinion, and FOMO – fear of missing out – on available properties, before they start increase in price even further due to cheaper mortgages.

Development of inter-banking rates since 2008:

Another piece of good news is inflation is now at 2%, which is the target value of CNB since 2010 and the lowest since 12/2018.

On the downside, savings accounts will promise lower and lower interest rates for deposits. Right now you can still find banks offering savings accounts with interest of 5-6%, but this will not last very long in my opinion.

Practical tip: A client approached me asking if they can pay back a part of the mortgage they took a few years ago. By the law, you can repay 25% of the original mortgage amount per year so yes, they can do that. However, their mortgage interest rate is 3%. From a mathematical point of view, it is more effective NOT to repay the mortgage now.

Just put the money into a savings account to earn interest and when savings account rates are lower than the mortgage interest, move the money from savings into the mortgage.

Would you like us to write about your business? Find out more

-

NEWSLETTER

Subscribe for our daily news