About two years ago, buying a property was quite challenging. If you were looking to purchase a property then, you might remember there were often multiple interested parties and most properties were sold very fast, often resulting in bidding wars.

I believe now we are seeing signs that we could be returning to that situation.

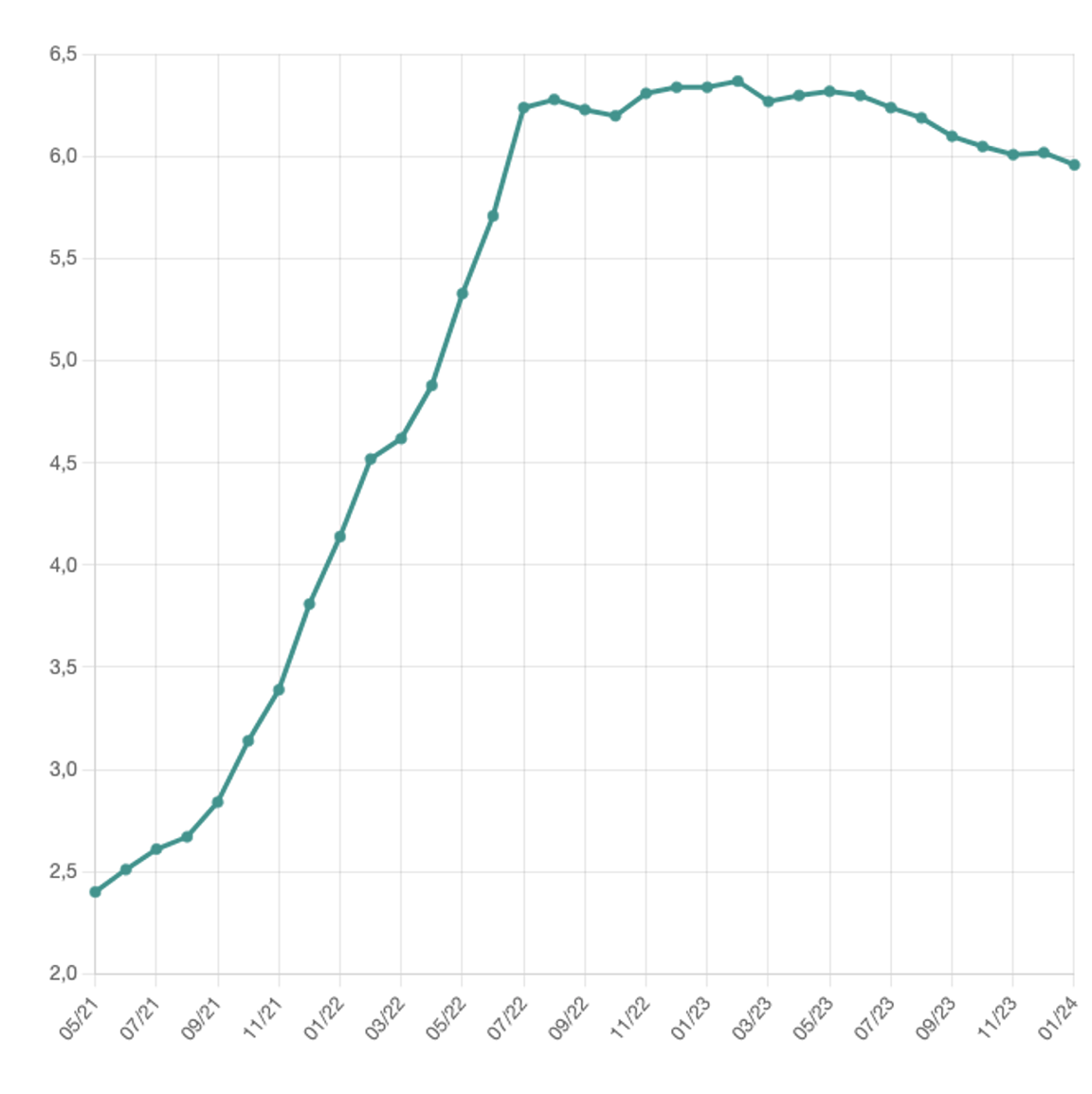

The main reason for the drop in real estate transactions in 2022 and 2023 was the soaring interest rates. The Czech National Bank (CNB) increased the rates during 2021 and 2022 and banks followed with increasing mortgage rates, which is best shown in the graph below.

Source: average offering interest rates on all fixations by hypoindex.cz

As a direct result, there was a massive reduction in mortgage production. Some months saw a drop of 80% year-on-year! This in turn led to significantly fewer property purchases and many regions suffered a drop in prices. At some point, prices were down 20% in areas such as Cerny Most in Prague, or Ostrava.

The reason for this was simple: People who needed mortgages to purchase a property were thinking about the costs of the monthly repayments. If the rates went up from 2% to 5.5%, for example, monthly repayments increased by roughly 50%.

For the same mortgage, instead of paying 20,000CZK, you repay 30,000CZK. People who had their fixation periods ending at that time were up for an unpleasant surprise, though luckily not as bad as in some countries where floating rates are standard and therefore no protection when the national banks increase rates. At least in the Czech Republic, we have rates fixed for a certain period of time so borrowers can plan their cash flow accordingly for the next couple of years.

Now what is really interesting is though we are only in the third week of the new year, I can personally confirm more than triple the amount of inquiries for property purchases compared to December! After checking with other mortgage advisors, it’s clear that after a long time of waiting, many people decided to go ahead and explore the real estate market again.

What is the reason for this massive increase? For now, we do not have the data just yet so I can only speculate…

- In December the Czech National Bank lowered the inter-banking rate by 0.25% from 7 to 6.75%. This is only a minor decrease but it clearly sets the new path of future lowering of interest rates. I would not be afraid to estimate that by the end of the year, mortgage rates would be close to 4% or maybe, maaaaabye even a bit below

- The psychological factor at the beginning of the year. Many of us have New Year’s resolutions and buying a property can be easily one of them. While January is typically one of the calmer months, this year it is definitely not the case

- FOMO – or fear of missing out. When you know the rates are high and people were not buying for a while, combined with lowering prices in some areas, and maybe some people were thinking of this as a great opportunity to invest and leverage the market position of buyers. When the rates start to go down, in theory, that can lead to an increase in prices again so it might be a good time to look into this sooner rather than later. This rationalization could be on their minds.

To sum up, I would be very curious how the next few months go and whether the CNB will keep on lowering the rates, or whether this surge in buying interest is just a January thing and it will lower again. If this pace will continue though, we are up for some interesting times.

-

NEWSLETTER

Subscribe for our daily news