Mortgage Market Picking Up, Another Round of Deregulation by ČNB

Robin Petrasek

Almost two years ago, the Czech National Bank (CNB) introduced three regulating parameters to limit how much the banks could lend customers (DSTI, DTI and LTV), which essentially considered personal debt and income against the mortgage value.

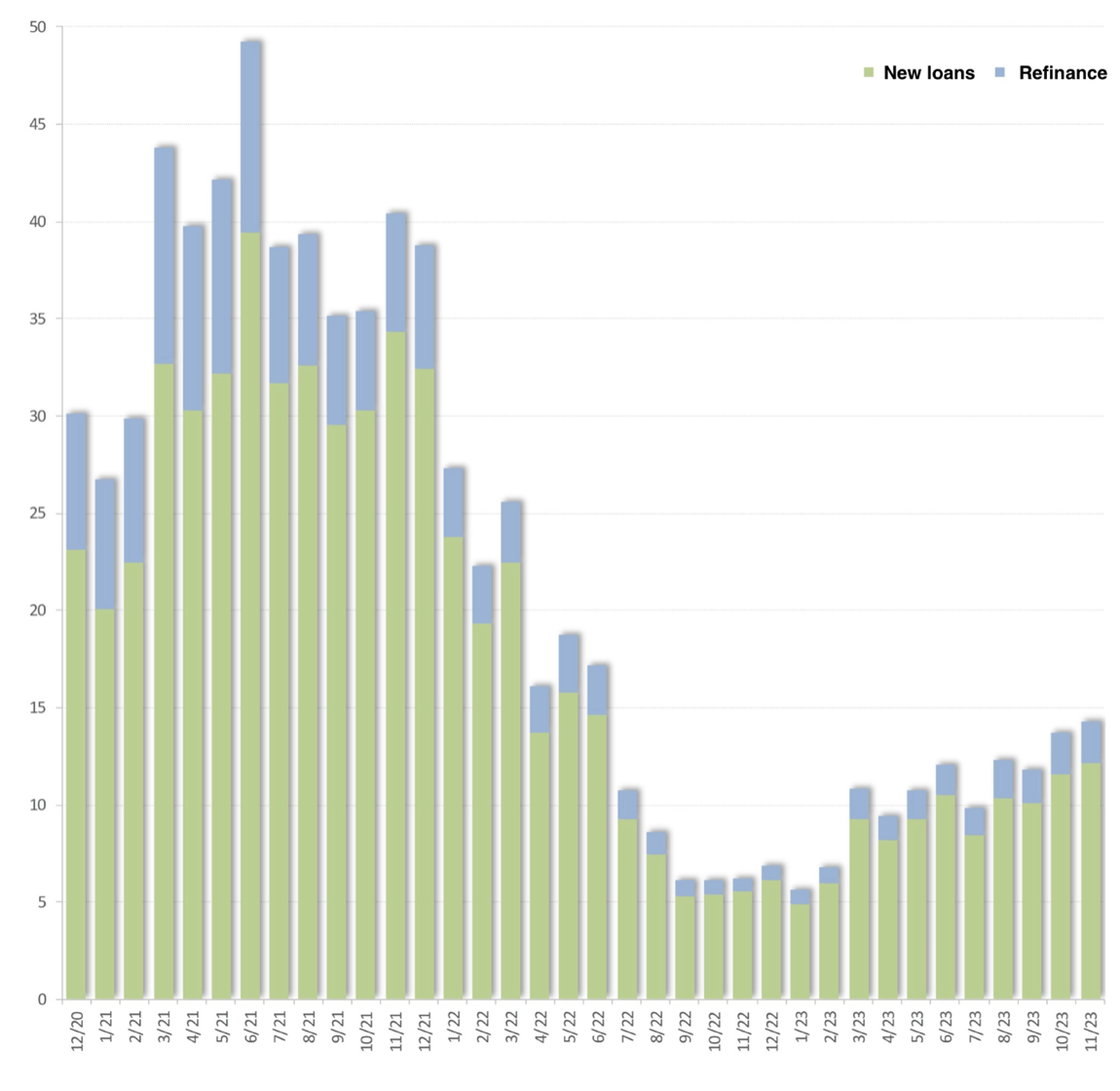

This, along with increased mortgage rates, really slowed down the amount of mortgages taken out recently. At one point last year, the amount of new mortgages were down 80% year-on-year, more on this below!

Now the CNB is removing the second regulation, DTI, or debt-to-income, on the banks meaning they could lend even more money to customers.

In all, I think it’s fair to say the mortgage market has gone through some crazy development.

To describe how low the mortgage market was a year ago, if we look at November 2022, 84% less mortgages were approved than November 2021. Minus 80% on production, that is quite something! Can you imagine your business revenues would go down this much? Banks were not having the “easy” times back then – but who would pity the banks, right?

However, if we now compare November 2023 with November 2022, there is an increase of mortgages approved. More than +120% in fact! How is that possible?

Source: www.gpf.cz/hypotecni-uvery-prosinec-2023

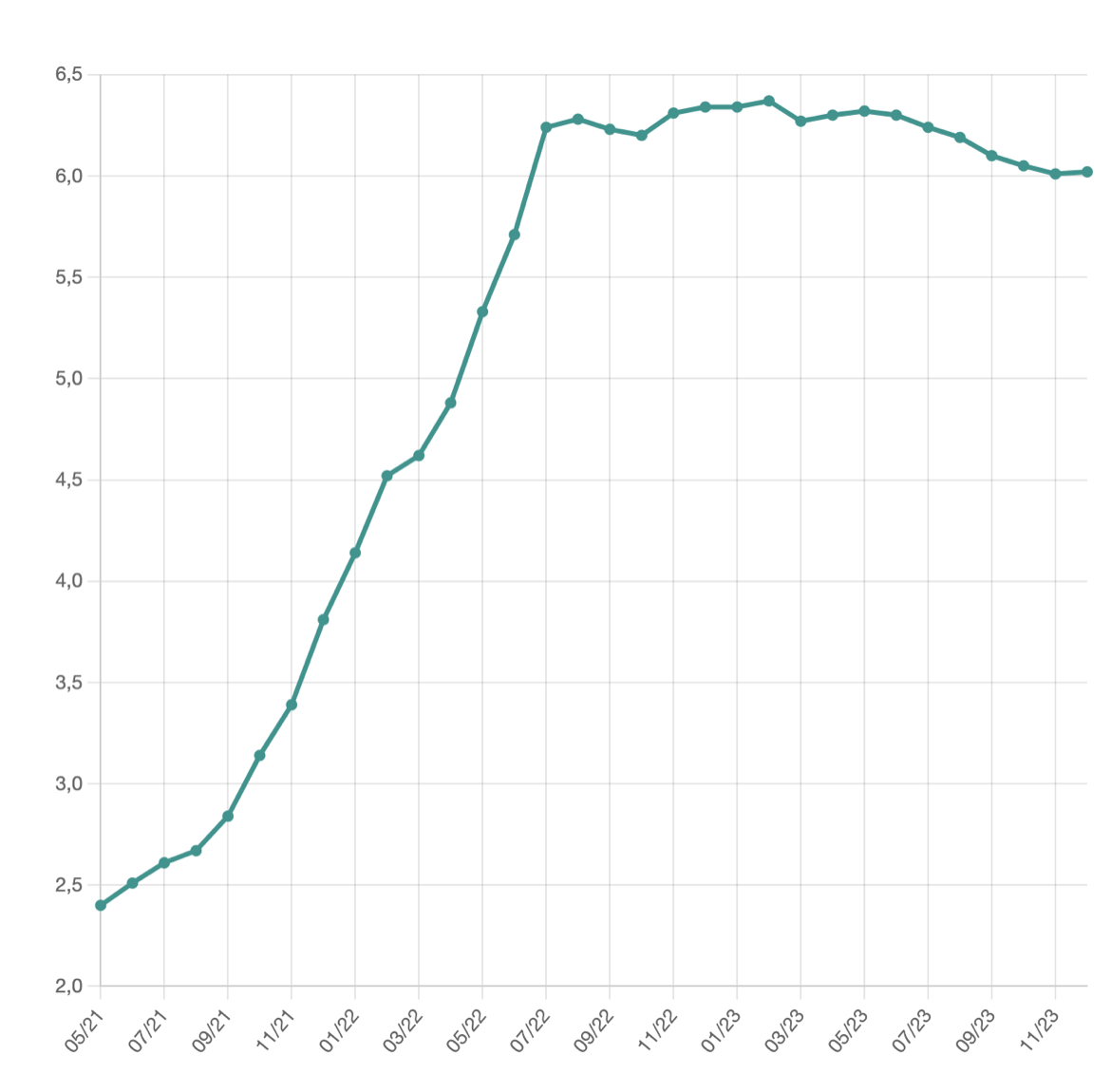

According to hypoindex.cz, last year in November the average offering mortgage rate for 5Y fixation was 6.07%. This year it is only slightly lower: 5.81%, so how come there are more than double the amount mortgages when the rates are essentially the same?

Average offering rate by hypoindex.cz

My answer is, it’s mainly a psychological effect and people started to see more investment opportunities around.

The best rates these days are around 5.19% and people simply started to get used to higher rates.

Besides that, 5-6% rates are nothing extraordinary if we look to other countries. In the Czech Republic, between July 2021 and July 2022, rates increased from 2.5 to 6% within 12 months.

That was the fastest increase in the recent history which caught most of the market off guard. People started to reconsider whether it is still viable to put money towards property investments while rates were close to 6%, while others did their refinancing way in advance to avoid something like a 50% increase on repayments.

If your mortgage had a rate of 2.5% and you increased to 6% during this period of time, then your repayments effectively increased by 50%!

As a mortgage advisor I confirm increased interest compared to a year ago, that is for sure.

How does this new deregulation impact the market now?

Not much – that is my expectation. Banks used to have limits for maximum borrowing compared to monthly net income of the household, usually up to 50% of net income. This regulator is called DSTI (Debt Service to Income) and was already removed months ago.

Now the ČNB is removing DTI – total Debt to Income – which was around 9.5 times the annual net income. Last regulation in place is the Loan-To-Value (LTV), which is set at 80% or 90% of the property value, depending on the age of the applicant. Typically only those ages 35 or below can get 90% but of course, there are always exceptions.

Can you borrow more money from the banks now?

Theoretically yes. But in real life, not yet. Banks need a bit of time to adjust to this new rule and it is quite possible they will keep strict rules themselves to prevent customers from overborrowing.

Basically, while the CNB might not enforce these rules anymore (DSTI and DTI), banks can internally decide to follow them nevertheless to limit riskier lending.

Oh, and I suspect property prices will slowly start to grow again, as long as the rates keep coming down. Slooooowlyyyy…

-

NEWSLETTER

Subscribe for our daily news